Developer & Owner Database Prices Rise May 1st

Existing subscribers will keep their legacy pricing

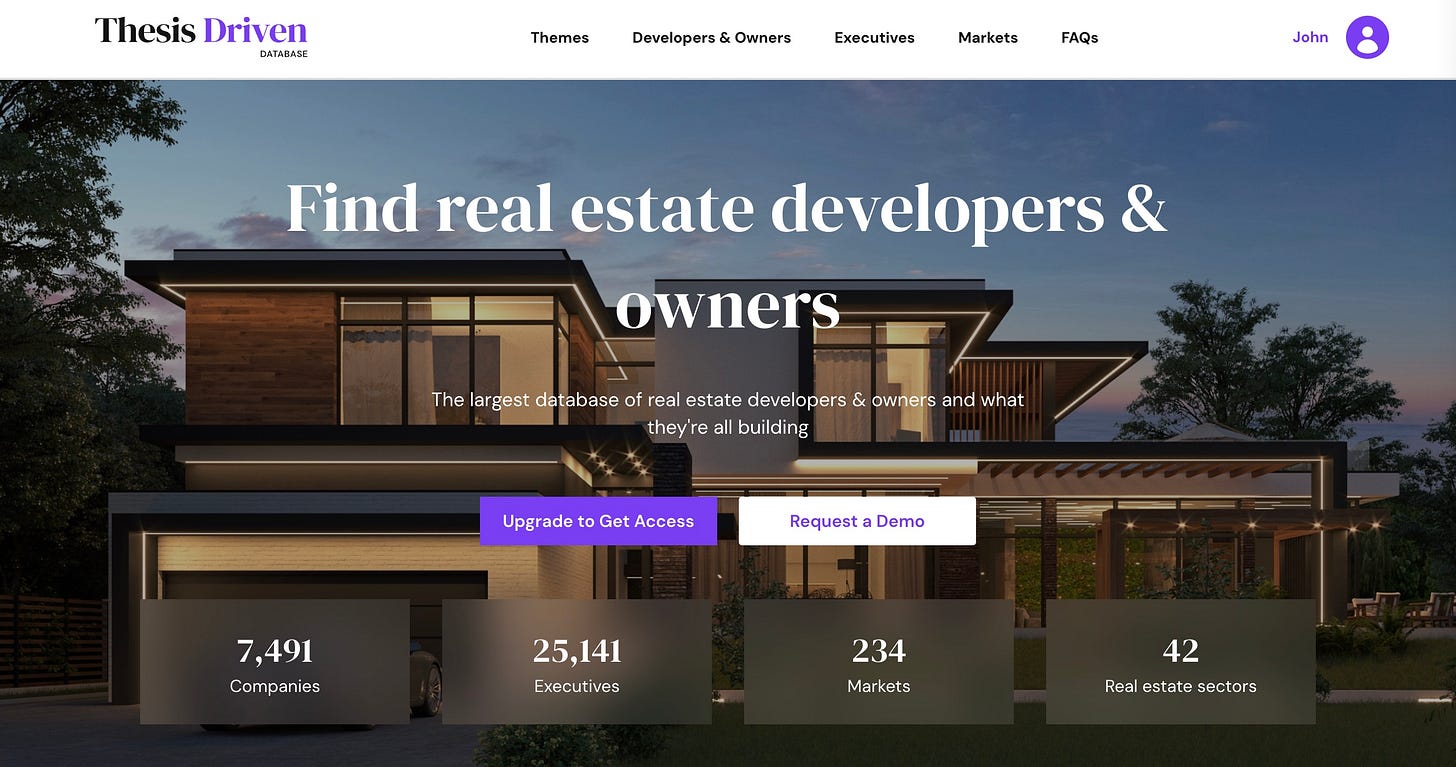

Thesis Driven’s real estate developer and owner database now features almost 7,500 active firms building and buying real estate across all the major food groups from multifamily to industrial to office and everything in between. It’s an indispensable way to build sales pipeline anyone selling into the real estate industry, and our hundreds of subscribers range from proptech firms to debt brokers to LP investors and more.

But it’s not cheap to maintain—we have humans reviewing each profile every 4-5 months, and we’re still adding 10-20 new GPs per day. So we’re raising prices to $199 per month starting May 1st.

The good news? Existing subscribers will keep their grandfathered pricing of $99 per month for at least the next two years. So if you subscribe before May 1st, you don’t have to worry about the price change.

Like our newsletter, Thesis Driven’s data is human-built and human-curated. In a world of plentiful—but imperfect—scrapers and AI, good data sets are hard to find. This is even more true in the real estate industry where even the best LLM struggles to differentiate a general contractor from a CRE broker from a real estate developer.

So just as we promise the Thesis Driven newsletter will never turn into AI slop, we guarantee we’ll continue giving our data that human touch—at least until AGI comes for us all.

Who should subscribe to the Thesis Driven database? In short, anyone looking to reach real estate asset owners, buyers, and developers:

Vendors & Proptech Companies. If you’re selling into owners, Thesis Driven’s database is the best prospecting tool out there, with contact info of more than 25,000 decisionmakers across 7,500 firms meticulously categorized by asset focus, recent news, location, and more.

Debt & Equity Brokers. Finding the long tail of builders and buyers is hard, especially if you’re targeting a niche sector or operating in a market with a lot of activity. We’re constantly browsing local news, filings (through ReZone) and more to understand who is doing what where.

LP Investors. We have a number of LP investors—mostly larger—who use the database to research GPs and find emerging sponsors. Our reach across 42 different sectors—from big categories like opportunistic multifamily to niches like marinas and micro-apartments—sets it apart.

Want to learn more? Check out a recorded demo here or go here to request a live demo or sign up!

—Brad Hargreaves