Everything You Need to Know About Raising a PropCo

We spoke with veteran real estate entrepreneurs to get their tips on raising PropCo capital in today's challenging environment

Thesis Driven dives deep into emerging themes and real estate operating models by featuring a handful of operators executing on each theme. This week’s letter digs into PropCo models from an operator’s point of view, including key structuring questions and fundraising tips.

We’ve written about OpCo-PropCo structures extensively in prior Thesis Driven letters, including the definitive list of OpCo-PropCo investors we published late last year. We also spoke with several investors on the future of the OpCo-PropCo model a few months ago.

Today’s letter will feature the entrepreneur’s view on the PropCo model. We spoke with three real estate operators with experience raising real estate capital for innovative real estate operators:

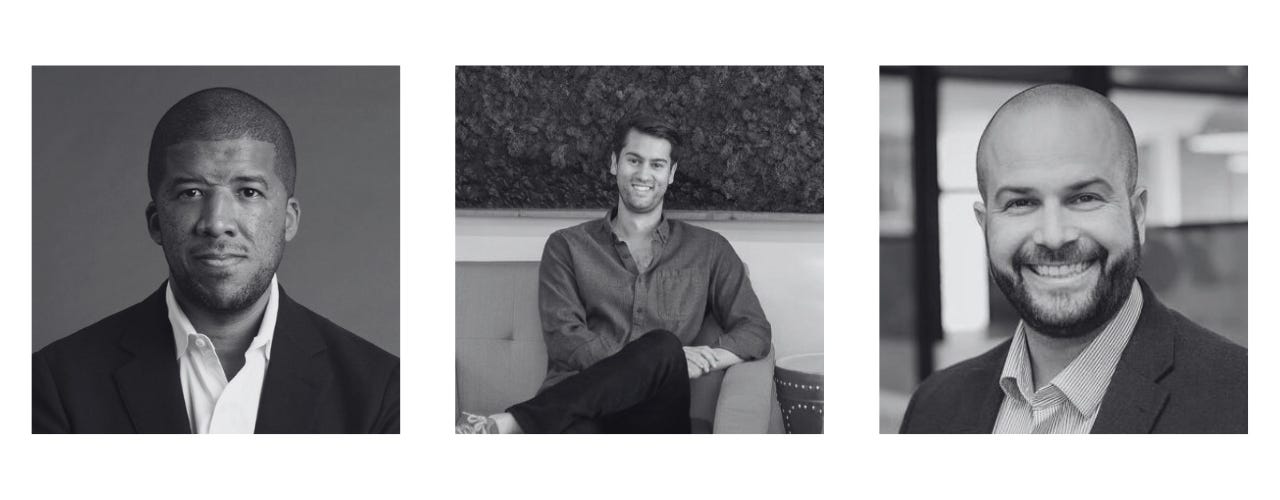

Andrew Collins, Co-founder & CEO, Bungalow;

Tyler Scriven, Co-founder & CEO, Saltbox;

Jason Fudin, Co-founder & CEO, Placemakr (formerly WhyHotel).

Their businesses span industrial, single-family rentals, short-term stays, multifamily, and co-living. Collectively, the three entrepreneurs featured here have raised over $1 billion in PropCo equity and debt capital. In this letter, we’ll hear from them on their experiences raising real estate capital as well what operators should look out for when structuring real estate partnerships, including:

When a ‘PropCo makes sense;

Types of ‘PropCo’ structures;

Key questions and decisions when structuring a PropCo;

Fundraising tips and strategies;

How to manage through the current tight capital markets environment.