Hot and Cold: Where Real Estate Tech Investors Want to Play in 2024

The results of Thesis Driven's biannual real estate tech investor survey

Over the past few weeks, we’ve surveyed almost 50 established real estate tech investors across a variety of stages and categories. Later this week, we’ll share details of specific investors and their favored categories, updating this list from six months ago—as well as each firm’s interest areas, ability to lead deals, recent investments, and PropCo involvement.

But today’s letter will focus on macro trends in investment interest: particularly, the sectors of real estate tech drawing the most interest from venture investors and real estate strategics today.

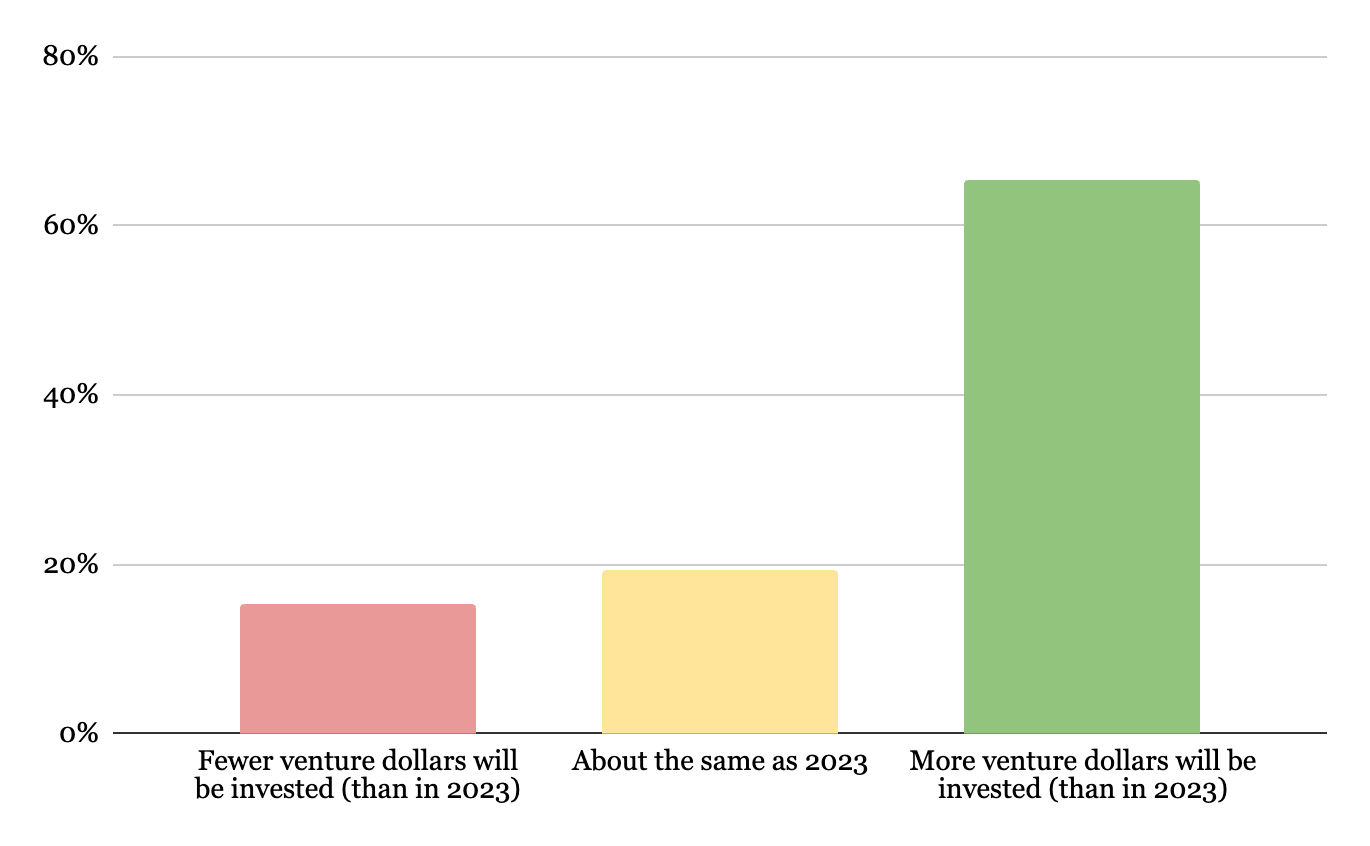

While 2023 was a down year for real estate tech investment—and venture at large—most investors believe that the market is on its way back. The majority of venture investors—approximately 65%—believe that 2024 will see more venture dollars deployed into real estate tech than in 2023. Only 16% believe that 2024 will see a continuation of declining deal volume.

But the bullishness isn’t spread evenly across real estate tech categories. Data & AI and construction tech, for example, are hot categories, with the vast majority of investors looking to do more deals there. Brick-and-mortar businesses, on the other hand, are on the outs, forcing entrepreneurs to look for alternative financing paths.

Today’s letter will walk through each major subcategory of real estate tech—data & AI, brick-and-mortar, SaaS, design, services, consumer, devices / IoT, construction tech, and clean tech—and discuss how each is faring in the venture market and how companies in those sectors might approach the market.