Real estate owners and developers are paying more attention to technology than ever. AI and automation have taken proptech from the fringes of relevance to threatening a reinvention of entire elements of the real estate business from acquisitions to underwriting to property management.

But for technology entrepreneurs and sales leaders, finding real estate developers and owners—their customers—is as challenging as ever.

Two things about the real estate industry make it somewhat unique in this regard. One, real estate is incredibly fragmented. In multifamily alone, the largest owners each have at most a 0.3% market share—and even large, institutional REITs have 0.1% to 0.2%. Great for TAM, terrible for being able to take down a decent chunk of the market with one or two contracts.

Two, real estate is geographically segmented. A large commercial owner may only operate in a handful of states. If a vendor wants to reach that owner, they have to meet them at their office in Youngstown or Billings or Dallas—it’s not safe to assume they’re going to attend the NMHC Annual let alone Blueprint or RETCON in any given year.

But the biggest and most accessible clients aren’t always the best ones. While many large REITs have teams dedicated to finding new tools, they also have lengthy and elaborate processes for winning their business—and entrepreneurs often find themselves stuck in “pilot hell,” executing on low-margin or even unpaid trials at a handful of assets.

A generational owner with 10,000 apartment units in the midwest, on the other hand, could be a great client: they have real technology needs, even simple tools can add real value, and they’re unlikely to have long sales and vetting processes. If you win over the asset manager and a principal, you’re in.

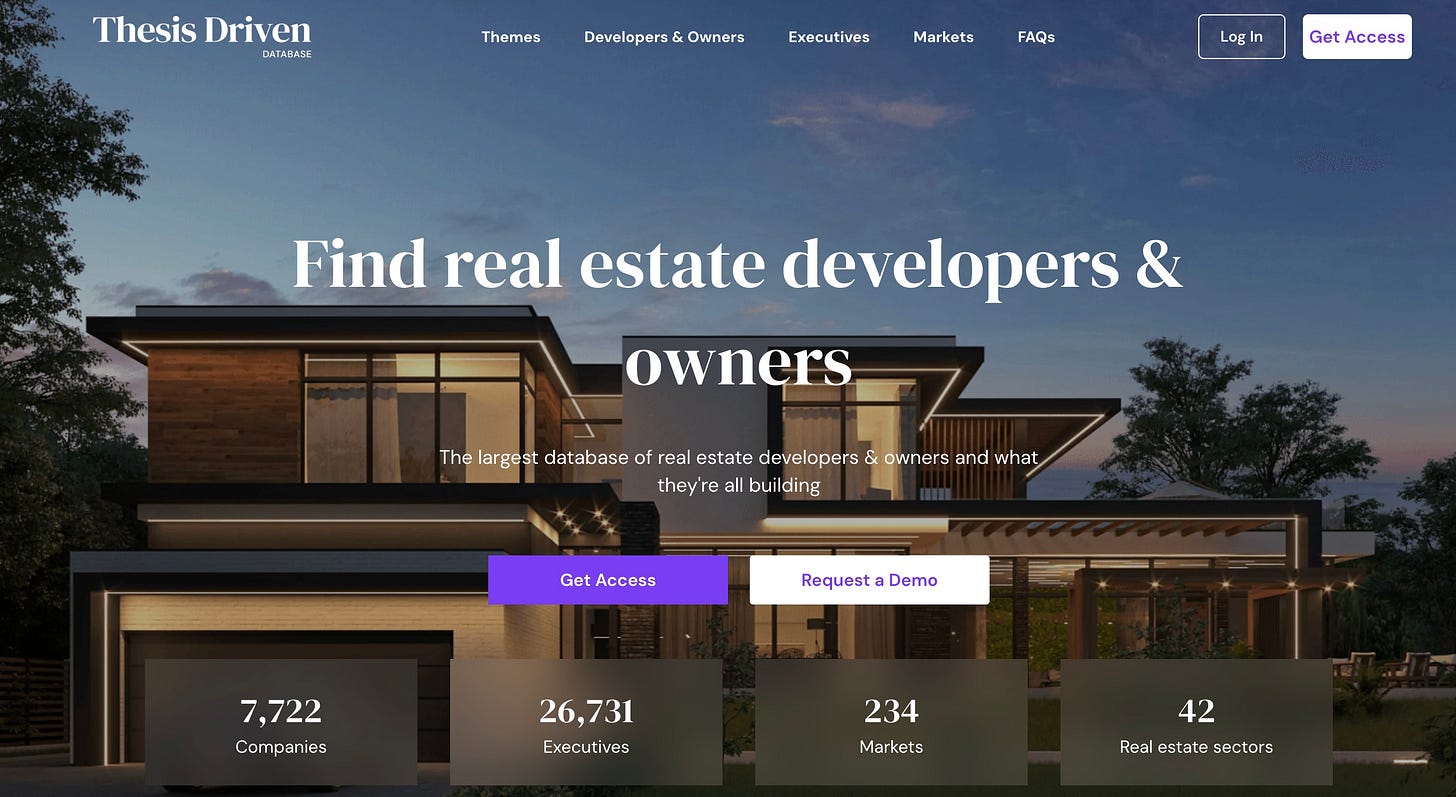

Editor’s Note: At Thesis Driven, we’ve built two things to help entrepreneurs solve this problem. One, the Thesis Driven Database now documents over 26,000 executives with contact info across almost 8,000 active real estate GPs—including core and value-add buyers across asset classes as well as ground-up developers. The tool is $199/mo and there’s no required contract—go check it out here and request a demo!

Two, we teach a five-week virtual course called Selling into Real Estate Owners. Students learn the basics of the real estate industry as well as tactics to find and convert customers. Through small (<15 student) weekly discussion groups, I provide students get 1:1 feedback on their tactics and strategies.

Self-promotion aside, it’s worth looking more broadly at how developers can be discovered. After all, we used a number of these strategies in combination to build our database:

Filing Data

You can pull permit and rezoning filings from tools like Shovels or ReZone (respectively). This is useful to get a sense of what’s happening on the ground, but most raw permit and entitlement data doesn’t reveal the actual developer behind the project.

Depending on the jurisdiction, it’ll typically list some combination of the project’s architect, attorney, contractor, or the special-purpose LLC that owns the site

Tying those LLCs back to the actual beneficial owner is possible but arduous. Tools like Acres can do it, but it’s usually only worth the effort if you’re in the acquisitions game—not selling software or services.

As a result, most “general” databases don’t have good structured information here. Contact info datasets like ZoomInfo, for instance, don’t do a great job of differentiating between the various roles in the real estate industry. And even specialized real estate-focused data sets may quote big numbers of “developers”, but upon inspection most of those “developers” are actually contractors, architects, lawyers, and SPVs.

Creating a good data set here requires building it by hand, which is how we built Thesis Driven’s database.

But there are other ways to find developers, each requiring varying amounts of work and creativity. Finding the top owners—the big REITs and NMHC Top 50—is not particularly hard. But the middle market, developers and owners with 5,000 to 25,000 units, is both the biggest challenge and often the highest quality customers.

Local and Trade Press

Despite the decline of local journalism, the press is still a great way to discover developers—particularly those tackling ground-up projects.

In most cases, local and trade press will do the work to find the developer behind the project rather than simply attributing it to the SPV that owns the site. Business Journals is a particularly good resource here with a national network of local journalists, and major local papers, free weeklies, and even local television networks can also be useful.

National trade press like The Real Deal, Bisnow, and Commercial Observer can be helpful, but they tend to be lower-volume and more oriented toward key coastal markets like New York, Miami, and LA.

Traded is also a useful resource, particularly when targeting core or value-add buyers. But their data is sourced from brokers, so it’s somewhat biased toward what local investment sales brokers want to share.

Conferences

Trade conferences—both big ones like Blueprint as well as regional conferences like Bisnow and IMN—can be a great way to meet developers and real estate owners. Real estate is still an in-person business, and nothing beats meeting potential customers in the flesh. Going to trade shows is a great way to immerse oneself in the industry while meeting potential customers.

However, I have to call out two caveats:

Many of the large trade shows have far more vendors than owners (buyers), although both RETCON and Blueprint have been intentional about recruiting more owners—particularly COOs and CTOs of operators across asset classes—to attend in recent years.

Conferences tend to attract the largest owners and operators who can afford to spend time at a trade show exploring new technologies and meeting vendors. Many smaller and middle-market firms simply can’t take the time away from the office, and those firms can be your best customers.

But it’s not ideal to just walk into a conference cold—the best entrepreneurs and sales leaders do the heavy lifting up-front, doing research and lining up meetings. The “sweet spot” for booking meetings is 2-3 weeks in advance: prior to that many executives aren’t yet thinking about the show; later the top buyers are already booked up!

LinkedIn

LinkedIn is indispensable for anyone selling to the real estate industry at scale. While only about 30-40% of GPs are active on LinkedIn, it’s by far the most reliable social tool for reaching them.

And it’s even more useful when paired with tools like LinkedIn Sales Navigator—their in-house sales tool—and third-party platforms like Dripify which help manage outbound campaigns without getting throttled by the platform.

One of my favorite things about LinkedIn is that it works as both an inbound as well as outbound channel, and the two strategies—when done right—reinforce each other. A great organic presence on LinkedIn with strong content with increase response rates for outbound campaigns, as more people are likely to have some familiarity with you as an individual or your brand. And engaging outbound will build your follower and connection count, exposing more people to posted content.

Of course, LinkedIn has plenty of quirks and nuances that must be understood to get the most out of the platform—which is why we spend so much time on it in our course.

—

This is far from an exhaustive list, and we haven’t even begun to dig into all the ways to attract inbound interest through content and inbound lead generation strategies. When we teach this in our five-week course, we explore over a dozen different tactics and approaches as well as dig into case studies of marketing done well.

Of course, all the marketing in the world won’t help if you’re not speaking real estate’s language. Talking in terms of NOI and operating expenses—as well as targeting the right people at the right firms—is a big part of executing well on any go-to-market plan. Getting in front of people doesn’t matter if you’re not telling them the right things. (That’s weeks one and two of the course!)

If you’d like to go deeper, reach out about our Developer Database or Selling into Real Estate course.

—Brad Hargreaves

I have always found that working with the business development people in design and construction firms is the fastest way to figure out who is active in a local market.