Seven Things I Think I Think About 2023

Plus the three most joyful real estate projects I've discovered in three months of writing Thesis Driven

Thesis Driven is now three months old. Over those months, we’ve covered emerging real estate themes ranging from office-to-residential conversions to ADUs to family-oriented apartments, each told through the lens of the talented GPs executing against those themes.

I’m excited about what 2023 will bring to Thesis Driven. I’ve been happily surprised with what we’ve accomplished here in a short time, both in terms of subscribers and GPs’ willingness to share their stories. The coming year will bring our first guest posts, a higher frequency of letters, and a bit of diversification beyond multifamily.

Today I’d like to share a few predictions for the coming year, which brings as much economic uncertainty as I’ve seen since I was working as a game developer in 2008—and perhaps as much geopolitical uncertainty as I’ve seen in my lifetime.

But first, I’d like to begin with a bit of a retrospective in the spirit of the holidays: the three most joyful real estate projects I’ve come across thus far while writing Thesis Driven. Note that these are selected by the highly objective yet festive metric of joy rather than boring ones like returns, yield, or scale.

The Most Joyful Projects of 2022

Blackwood Groves, Bozeman, MT

With the holiday spirit at heart, it’s going to be challenging for any project to compete with Bridger Land Group’s Kinkade-esque rendering of Blackwood Groves, a 900-unit community under development outside Bozeman, Montana.

But there are reasons to celebrate Blackwood Groves beyond its commitment to seasonal renderings. Blackwood is an example of the emerging trend of New Urbanist “car-light” communities that emphasize space for people and bikes over cars. Grocery stores, bars, schools, restaurants and more are within walking distance, a remarkable achievement for a greenfield project in a 40,000-person mountain west city like Bozeman. Original feature here.

YoungLewin Student Housing, Los Angeles, CA

While I have no Kinkade rendering for YoungLewin’s work, there is something particularly joyful about four college friends living together in a 4BR / 4BA ADU in a Southern California backyard.

Dan Lewin has developed perhaps the most unique ADU strategy I have seen to date: buy homes near college campuses, add a large ADU in the backyard, and rent each out to group of college students. And it’s working, generating some of the highest yields on cost I’ve covered in Thesis Driven. But most of all, it’s joyful. Original feature here.

Mily on Green, Philadelphia, PA

Does anything have stronger holiday vibes than a 108-unit apartment tower filled with families with kids? That’s a lot of Christmas (& Hanukkah) presents!

Families have long been underserved by urban apartment developers, who have historically favored building studio- and one-bedroom apartments over the larger two- and three-bedroom units better suited to families with children. Several developers are bucking this trend, reasoning that buildings designed with families in mind could achieve higher rents by specifically targeting renters-by-choice with quality amenities and a sense of community.

Elk Street Management is at the forefront of this trend with this family-friendly project on North Broad Street in Philadelphia opening in Q1 2023. Original feature here.

Real estate development is a challenging and risky business, and many of the best GPs are talented enough to have a successful and financially rewarding career in many other industries. The best GPs do what they do because they find joy in it: in creating new places, in providing homes for their residents, and in creating extraordinary spaces where people can thrive. “Joy” is not a trivial thing but rather a primary motivator that drives great people to build wonderful places.

Now on to the predictions:

1. The Fed will overshoot rate hikes and will be forced to backpedal by 2H 2023.

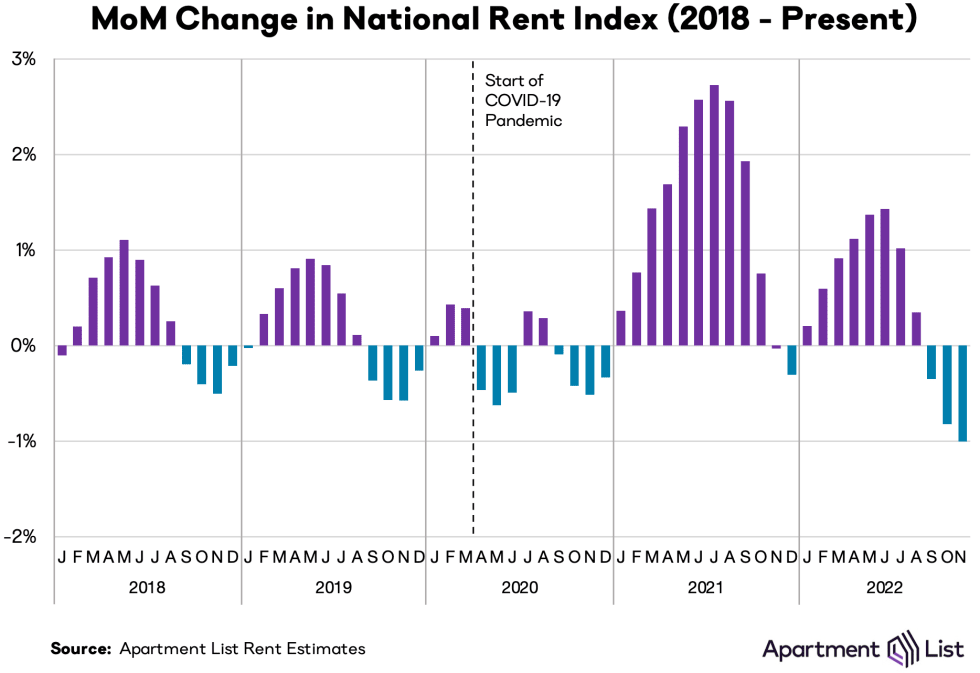

While “the Fed is overshooting” is not a novel opinion, it becomes more obvious once we consider how rent is calculated in CPI. Rent and owner-equivalent rent make up almost a third of CPI, and this “Shelter index” is still increasing as a marked pace despite market rents beginning to cool in many major US cities. Rental economist Jay Parsons explains it well here: rental loss-to-lease has rapidly declined across markets, leading to less runway for renewal rents and lower rent increases moving forward. The Shelter Index–which is largely driven by a survey of trailing rents–acts as a lagging indicator of rental prices.

Despite a majority of industry sources citing nationwide rent declines beginning this past fall, as of the last CPI print (November 2022), the shelter index increased by 0.6% month-over-month reflecting lagging data. In November’s CPI, the Shelter Index was the single largest driver of consumer inflation in the entire price index. Once the Shelter Index begins to account for the rent declines happening today, headline inflation should show a speedy decline, potentially forcing the Fed to backpedal by the second half of 2023.

2. “Hybrid” office cultures will disappear.

From conversations I’ve had over the past six months, my experience indicates that CEOs have settled into two camps: Those who are passionately committed to building a fully-remote organization and those who are gnashing their teeth to find a reason to ask their employees to return to the office at least four days per week. I have not met a single CEO who has expressed enthusiasm for a hybrid approach, and the latter category outnumbers the former by a decent margin even within the tech industry. Political leanings aside, many technology CEOs were quietly rooting for Musk when he abruptly ended Twitter’s remote work policy last month.

While it’s likely true that great managers can get the most out of their employees remotely, it’s a fantasy to assume that any organization of sufficient scale is stacked with nothing but great managers, and executives know this. So what’s been holding them back? Record-low unemployment and wage growth has given white-collar employees the power to push back, short-circuiting many executives’ best efforts to force a return to the office. But if the Fed continues on its current trajectory and layoffs intensify in the coming months—see point (1) above—the power balance will likely swing back.

Note that I’m bearish on hybrid organizations, not fully-remote ones that were forged over video calls and Discord. Those companies exist, and their founders are very vocal on Twitter. But I don’t think most companies—particularly large ones—have the willingness or ability to get there.

3. Venture funding will bounce back, but new funds will be harder to raise.

There is a lot of dry powder on the sidelines. Nowhere is this more true than the world of venture capital, where venture funds raised more than $150 billion across 593 funds in the first three quarters of 2022 in comparison to $147 billion in *all* of 2021. However, capital deployment has not kept pace, as the past few quarters have seen a rapid deceleration of the pace of venture investment into companies from late 2021 all-time highs. Q3’22 deal velocity was down 37% from Q2’22 as investors grappled with declining valuations.

That is to say, there’s a lot of dry powder out there, and it has been a very long time since venture firms regularly returned capital to LPs because they couldn’t find enough deals to do. Unless that practice comes back after a 20+ year hiatus, one must imagine that deal velocity will return with gusto in 2023 and into 2024 as firms look to deploy that capital, possibly running up valuations yet again as firms compete over limited viable companies in favored sectors.

That’s not to say all is up and to the right in the venture markets. With 2022’s pullback in both the equity and debt markets, institutional LPs are now heavily overweight venture capital and are predicted to pull back and make fewer new commitments to funds in 2023.

4. The STR Nuclear Winter will begin

Oversupply and demand contraction are combining to make 2023 a very, very difficult year for the short-term rental business.

First, let’s start on the supply side. Airbnb listings are up 23% year-over-year with over 80,000 new listings coming on to Airbnb per month this past summer. Compounding the problem, a large portion of the new supply is investor-owned, dedicated short-term rental properties with lots of availability. The supply problem is likely to get worse over the coming year, as would-be home sellers with existing, low-rate mortgages choose to rent their homes out rather than sell into a tough market.

Things do not look better on the demand side of the equation. To begin, hospitality occupancy is very sensitive to macroeconomic conditions, and hotel industry insiders are forecasting declines in occupancy and ADR in 2023 in anticipation of a “mild” recession. It is also likely that 2021 and early 2022’s extraordinary run in STR revenues was partly driven by pandemic-era spending and behaviors that aren’t likely to continue.

Qualitatively, by early 2022 the short-term rental sector was getting get-rich-quick vibes as retail investors increasingly gained interest in the space. Articles targeting retired doctors and claiming 20%+ cash-on-cash yields is as close to a universal indicator of a peak as they get. There was also a growing cottage industry of picks-and-shovels businesses helping others buy and manage STR properties, with enough courses on getting rich in short-term rentals that we got lists and aggregators of courses on getting rich in short-term rentals.

In light of all this, a pullback seems inevitable and will hit publicly-listed companies (e.g., Sonder), privately-held firms (e.g., AvantStay) and retail investors all.

5. The trades will gain popularity among Gen Z

People in Gen Z—born between 1997 and 2012—have spent the better part of the past decade watching their Millennial forebears slam their collective heads into a socioeconomic wall, buoyed and ultimately undercut by the promise that they could “go to college, study whatever, enter an unremunerative field, and magically live a rich lifestyle.” The problems the Millennial generation faces—student debt, unaffordable housing, and a lack of marketable skills—are well-documented and certainly familiar to most Zoomers.

And those Zoomers want no part of it. There is some evidence that Gen Z is more open to joining the trades than prior generations, although data is limited and most surveys are commissioned by groups with a vested interest in the outcome. But those Zoomers that do opt to join the construction or manufacturing trades will be handsomely rewarded: there is currently a severe shortage across the trades that is only expected to get worse. Welders, electricians, plumbers, carpenters, mechanics, and more are in high demand, an imbalance that will only get worse as Boomers retire and immigration continues at a historically slow pace.

Some new companies are picking up the mantle here, often supercharged by the Inflation Reduction Act’s apprenticeship incentives. Former DC Public Schools Chancellor Michelle Rhee’s BuildWithin is one example, helping employers manage apprenticeship programs for new workers. But I believe more innovation is to come here as Zoomers look to forge different career paths.

6. AI-generated media will have a lead role in at least one major geopolitical crisis.

In March 2022, a video of Volodymyr Zelenskyy apparently surrendering and encouraging Ukrainian soldiers to lay down their arms emerged on social media. The video was a low-quality deepfake, but it is indicative of the challenges that await as AI and machine learning reach an inflection point of sophistication. While OpenAI pushes the boundaries of machine-generated images and text, realistic video (and accompanying audio) remains the AI holy grail and a rubicon that will likely be crossed in the coming years–if not sooner.

This technology’s potential for chaos cannot be understated. Realistic videos will emerge of natural disasters, bank runs, or street violence. Of declarations of war from foreign leaders or claims of nuclear launches. Ukraine’s government acted quickly to calm nerves and avoid a panic after March’s fake surrender video, but not every government will act as swiftly or effectively to avoid a situation spiraling out of control. As the pace of AI sophistication accelerates, I predict that machine-generated media will play a role in at least one major geopolitical crisis in 2023.

(One final note: perhaps most frightening is not what people will be led to believe by a fake video, but the proliferation of fake media leading to a truthless world, a society in which nothing can be trusted or believed. I don’t believe we’ll be close to that point by 2023, but how we perceive media is worth watching in the coming years.)

7. Defense Tech is the “place to be” by the end of 2023

While defense tech is certainly a hot category in venture right now–Anduril recently raised $1.48 billion and its secondaries are apparently in high demand–I believe there’s much more to come here.

Russia’s invasion of Ukraine and an increasingly aggressive China have prompted countries from Germany to Japan to Kazakhstan to Sweden to significantly boost military spending. Global military spending just passed $2 trillion per year and is expected to accelerate in the coming years. An increasingly multipolar world is not a safer world, and democratic countries cannot rely on the United States–with the GOP increasingly insular–to defend their interests.

For defense technology companies, this means more customers. No longer are they reliant on the US as the sole large spender in the democratic world; other nations are increasingly looking to modernize their militaries and tactics. And if Ukraine has taught us anything, it’s that this doesn’t necessarily mean bulk IFV and aircraft purchases from Lockheed and Raytheon. Small, cheap drones, electronic warfare, and social media are all key components of 21st century warfare. Startups are well-suited to provide solutions here at lower cost than large defense contractors.

As the war in Ukraine shows no signs of stopping–and a weakened Russia will likely lead to destabilization in other regions such as the Caucasus and Central Asia–defense tech will only get more attractive through next year.

This comes with the typical caveats about how no one knows what the future brings and we live in a time of great uncertainty all around. But as is the case with any market cycle opportunities will inevitably arise, and lean times tend to be great moments to build iconic companies.

In the meantime, have a joyful holiday and New Year.

yours,

Brad