State of the Market: Interviews with Top Proptech Investors

Perspectives from real estate tech investors on the VC market, sectors of interest, and where they're making bets

This week’s letter is a guest column by Ehson Kolb, the author of Mark 2 Market, a newsletter about the intersection of technology, real estate and finance.

The venture market for real estate technology companies is at its most difficult point in years, with private capital investments in the sector falling dramatically in the first half of 2023. While some non-venture financing models are gaining traction, many operators are still looking to the venture market to finance their businesses.

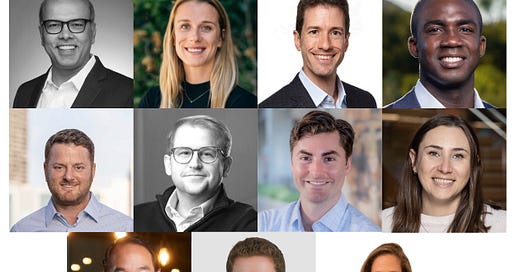

To help operators understand the market today, we interviewed almost a dozen investors at the Blueprint real estate technology summit in mid-September. We heard their views on the market as it stands today, how they’re approaching new investments, and the sectors that are seeing the most traction and drawing the most interest among venture investors. We interviewed investors across stages and strategies, including several strategic VCs from the real estate industry. Featured investors include:

Dan Sachar, Douglas Elliman

Preseed to Series A, $500K to $1.5M

Dylan Ketcham, Moderne Ventures

Late Seed and beyond, $250K to $15M

Michael Yang, OMERS Ventures

Series A to Series C, $5M to $20M

Jeremy Kaner, Olive Tree Ventures

Preseed to Series A, $10K to $1.5M

Prashant Kothari, Hamilton Ventures

Seed, $500K to $1M

Gavin Myers, Prudence

Seed to Series A, $1M to $6M

Courtney Cooper, Alate Partners

Preseed to Series A, $500K to $3M

Kat Collins, 1Sharpe

Preseed to Series A, $500K to $1.5M

Breton Birkhofer, DivcoWest

Seed to Growth, size varies

Adam Demuyakor, Wilshire Lane

Seed to Series A, $1M to $10M

Alexandra Nicoletti, Camber Creek

Seed to Series A, $3M to $10M

Today’s letter will dive into these investors’ perspectives on:

The state of the real estate tech investing market today;

The sectors and business models drawing investor interest today, including data, AI, workflow automation, and integration platforms.