The Capital Stack Walk Back

More GPs are choosing to raise from family offices and HNWIs rather than institutions. But do they know how?

For decades, raising capital from institutional investors was the highest aspiration for real estate sponsors. Institutions wrote the largest checks, conferred legitimacy, opened doors to brokers and lenders, and signaled a certain level of sophistication.

But in recent years, institutional capital has lost some of its luster. Since the 2022 pullback, raising from institutions has become a slower, more demanding, and more uncertain process. Allocators have become more selective. Many are overallocated. Others are sitting on the sidelines. And for those who are still active, the bar for new manager relationships has only gone up.

At the same time, the constraints of institutional capital have come into sharper focus. Institutions demand exclusivity. They push fees down and assert control over strategy. And they bring concentration risk: if a sponsor’s institutional partner shifts strategy, the business plan can fall apart overnight.

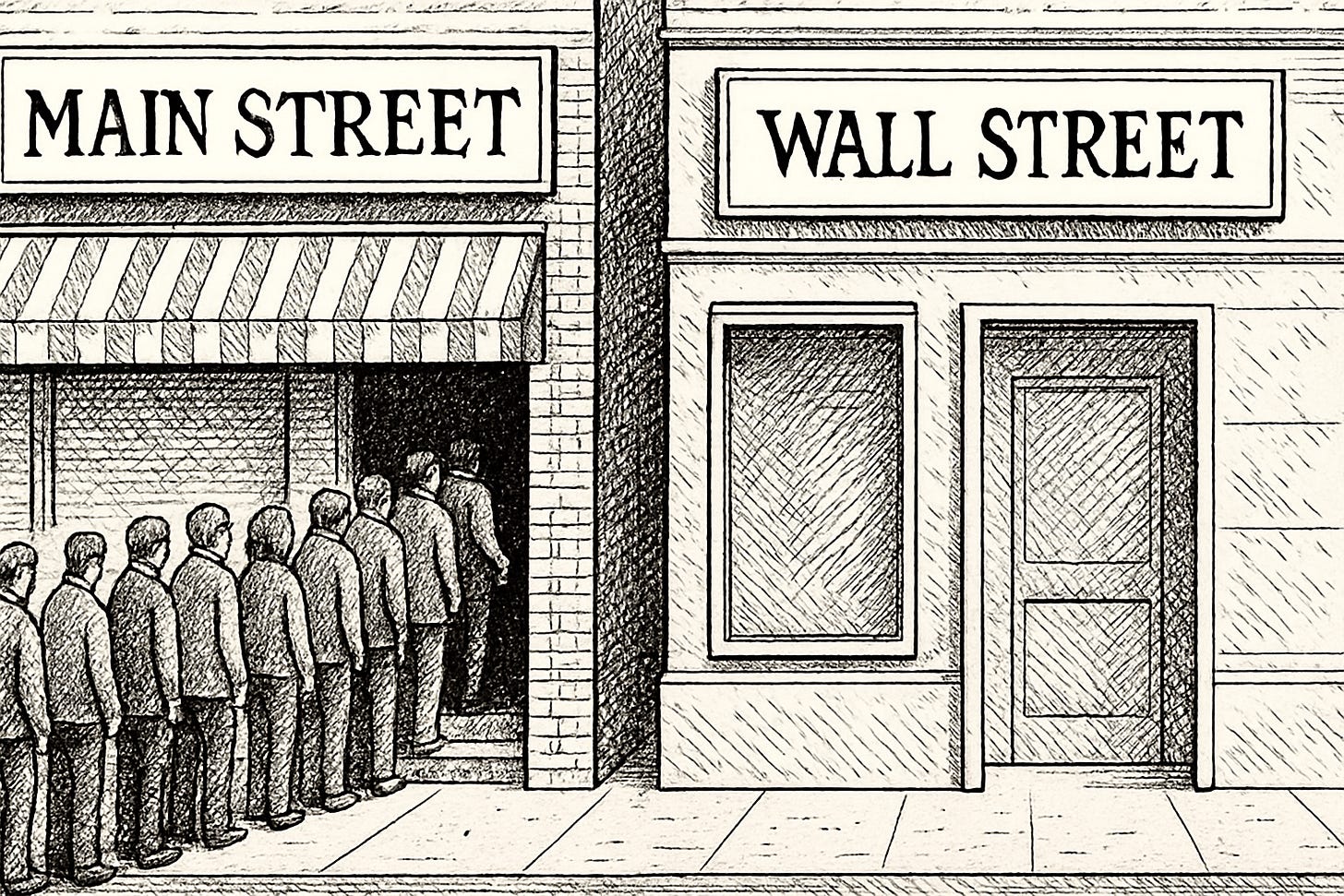

So, increasingly, sponsors who can raise institutional capital are choosing not to. Instead, they are turning to family offices, high-net-worth individuals, and other forms of retail capital. For many GPs, this isn’t about desperation as much as control, flexibility, and speed.

But making the transition isn’t as easy as it may seem. Institutional-caliber sponsors often struggle to communicate with retail investors. The muscle memory they’ve built pitching pensions and endowments doesn’t always translate. Telling your story to a dentist in Phoenix or a second-generation family office in Houston requires a different tone, different materials, and a different approach.

The archetypal syndicator is a Grant Cardone figure waving stacks of cash outside his G550. Meanwhile, the institutional GP is more reserved—deep in the spreadsheets, conservative on leverage, focused on downside protection. They may speak different languages, but they are increasingly competing for the same capital.

This letter is about how real estate sponsors can bridge that gap. Specifically, we’ll tackle:

The challenges of institutional capital today;

How family offices and HNWIs differ in outlook and approach;

Tips for “institutionally-minded” GPs on tweaking their pitch for family offices and HNWIs;

NB: Thesis Driven’s Fundamentals of Capital Raising course digs deep into all these issues and more. You can learn more about that program here.