The Future of Real-World Entrepreneurship

SMB is changing - here’s how and why it matters to real estate

Editor’s Note: Yoni and the team at Slow Ventures are some of my favorite thinkers at the intersection of culture and business. Their views on where SMB is headed aren’t squarely in real estate but are relevant to every Thesis Driven reader. So I invited Yoni to share his thoughts in today’s Thesis Driven. You can read more from him at 99% Derisible here. —BH

Entrepreneurship is the cornerstone of the American economy. It’s cliche to say it, but small businesses and new business formation are the twin engines of the economy in good times and bad. Small business growth drives employment, generates wealth, and invigorates communities.

Crucially, entrepreneurship is also a uniquely American response to crises and instability. Americans are risk-on psychos; when times get bad, we lever up.

In 2008/the GFC, the laid-off worker learning to code and the sole proprietor grinding in a WeWork became the indelible aesthetics of the time. Etsy was born. But there was a darker side: gig work proliferated under the marketing of “be your own boss.” Workers ultimately learned a painful lesson about trust and self-reliance under the indenture of Uber, etc.

In the pandemic, when people become unmoored from their jobs (via WFH or layoffs), entrepreneurship boomed again. New business starts (including by likely employers, not just sole props) shot up and have stayed up—up and down the labor/earning ladder.

The world is more unstable than ever so we should expect entrepreneurship to keep booming.

But PE buyouts and corporate consolidation are killing that dream. PE is crushing small business by:

Consolidating supply and squeezing customers.

Breaking the promise of self reliance that owners made (implicitly or otherwise) to their employees. Family businesses don’t stay that way anymore and when they get acquired the employees become grist in the mill.

Cutting off talent from wealth creation.

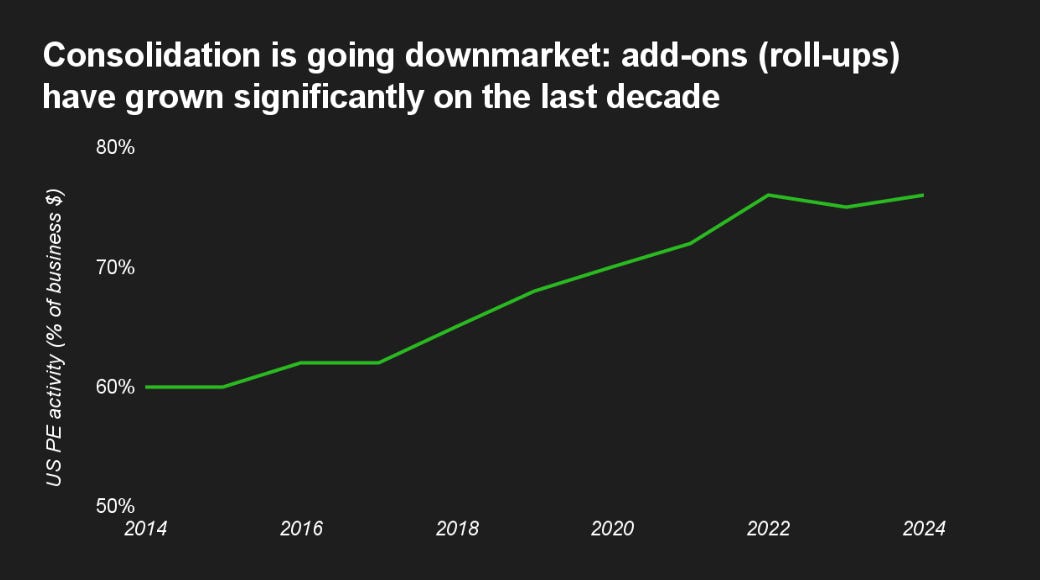

Rollups are all the rage and consolidation is coming downmarket. Instead of buying and rebuilding (sometimes breaking up) big companies, buyout firms now have their eyes set on mainstream and local businesses.

I believe that this future isn’t yet set in stone. There are multiple simultaneous forces coming together to create a unique moment to build platforms and businesses that release America’s entrepreneurial potential energy:

Entrepreneurial culture: just like tech replaced big law and finance as the high status job for the 2000s, real world businesses will replace big tech.

Technology: with AI, small companies can do way more with way less. Little guys can win.

Capital markets: as more businesses get rolled up, the best people will get pushed out to do it on their own.

The end of SaaS: as software LTVs go down and CACs go up, the world is moving beyond software as its favorite business model.

Let’s break down each of those individually.

Entrepreneurial Culture

There’s always been a class of the best and brightest who carve a path for ambitious young people and represent the cultural ideals for success:

In the 60s and 70s, the bright go-getters went to work at big companies that made things in America for the American Century like GM, GE, and DuPont.

In the 80s and 90s, the next cohort went into finance and big law to get right with globalization and corporate consolidation.

Through the 2000s it’s been all about tech—startups and eventually/especially big tech companies—as software became obvious.

So now, in an unstable, multipolar world where will bright, ambitious people turn next? Now that Facebook and Google are uncool, interest rates are high, software competition is going infinite, and institutions feel unreliable, what is the next high status path that will dictate our economy?

They’re going all in on cashflow and independence because they’ve learned that institutions won’t take care of them and can’t monopolize opportunity.

Free cash flow and independence (two sides of the same coin) are hedges against uncertainty, institutional decrepitude, and burnout.

Becoming a creator, buying SMBs/ETA, investing in real estate, drop shipping, building microsaas, forming personal holding companies, etc. are all trendy because they’re opportunities for ambitious (young) people to work for themselves and generate FCF as owners and operators instead of employees.

The next great migration is coming and talent will start flowing out of tech if it isn’t already. It might be harder to recruit for tech but there will be new companies to build for the new epoch.

Technology

AI is completely rewriting the rules of scaling companies and competition.

On one hand, huge companies will be able to get bigger (AI is great for coordination and communication, big returns to scale on data, distribution is everything) more profitably. Certain diseconomies of scale will soften or break down. But it’ll be great to be a big company.

Middle market companies will struggle. Neither nimble enough to win on speed and execution nor big enough to win on scale and reach, they’ll be caught in the valley of death. Many will get aggressively consolidated into bigger platforms.

But on theother extreme, small companies will thrive because they can deploy AI the fastest (use AI with fewer barriers even if not make it or use it the “best”), use AI to the greatest effect (highest returns on effort/low baselines in many functions), and face fewer barriers to entry (progressively lower startup costs). There will be more successful companies and the smallest (down to sole props) will outkick their coverage.

Whole functions and departments that were once the exclusive domain of large companies are now accessible to small and mid-sized businesses. With AI and with newer software more broadly, any company led by a sufficiently resourceful and ambitious operator can access best-in-class capabilities in finance, back office, marketing, legal, customer support, and analytics.

Owners and operators can automate workflows, plug into AI-powered platforms, and make strategic decisions with a level of precision and sophistication that rivals or even surpasses much larger firms. Going from a zero or 1/10 on these kinds of things to even a passable level is a huge improvement.

Today, a sole proprietorship or very small business can scale and succeed in ways previously unthinkable. And for small employers, these tools in the aggregate are a game-changer, bringing sophistication that normally only comes with size and consolidation.

Who needs an institutional owner when you have ChatGPT?

Capital Markets

The newfound aggressiveness of buyout firms to consolidate and roll up anything it can will backfire in talent markets. When private equity enters a market in force, the best people look for the exits and demand for “business in a box” options (more on that later) shoots up. There’s some signs this is already happening, especially in healthcare.

People don’t want to work for faceless financial institutions or, worse yet, the 29 year old MBA who flies out once a month to “rally the troops” (threaten a layoff). And as interest rates go higher, debt burdened businesses will be under even more pressure to cut further and push employees harder. It will be ugly. Anyone with options elsewhere will exercise them.

The End of SaaS

When building app software was hard, there was a moat in software. The products weren’t easily replicable and that was enough defensibility.

As building application software becomes easy (or even automated because of AI code generation) the execution, biz logic, systems, etc. become the moat. But that kind of moat is hard to prospectively underwrite even if it’s relatively easy to identify at scale. So pure application software businesses are increasingly unappealing.

Eventually/soon we’ll get to a world where someone can just ask GPT-10 to “build me an app to do X, has these features, and looks like this screenshot.” At that point, there will be no moat and infinite competitors for application software.

Software companies (and their margins and outcomes) will generally compress to look services companies: easy to start, usually not very big, little or no need for outside capital at inception, etc.

All told, software is depreciating very quickly, and pure-play software companies look uninvestable on the basis of technology alone.

Instead, it’s becoming obvious that the “software” businesses of the future will be more like compound companies that combine software with operational excellence, services, and/or real world physical businesses. And software might be the least interesting part of that to work on!

So what do you do about this?

In February we published our SMB thesis detailing the opportunities we see for technology companies to empower long tail, real world entrepreneurs building businesses and wealth for themselves.

Our central bet is that software and systems for SMBs can replicate the benefits of scale and consolidation without sacrificing independence: profits, competition, and growth in a more decentralized economy.

We see the vertical bets across three type of companies/business models:

Tools (vSaaS, fintech, etc) to improve profits, streamline operations, and put operators in charge of their destinies.

Orchestration & aggregation (marketplaces) to put growth on autopilot while business owners focus on what they do best: serving their customers.

The system (biz-in-a-box / franchise) for entrepreneurs to become business owners quickly with support, structure, and services.

These companies will usually be organized around verticals/categories and while the distinction between tools, marketplaces, and systems might seem fuzzy at first blush it’s an organizing pattern that becomes impossible to ignore once you see it:

We also identify five more horizontal/generalizable opportunities to build and back companies that can power SMB success:

CRM/marketing: become the customer and revenue hub and ad network built on first party data. Finding customers is the biggest challenge for SMBs.

Hiring: Headcount is the biggest expense and labor churn is death. Finding better talent faster and keeping it longer makes or breaks the business.

PEO/benefits: benefits are the 2nd biggest expense. SMBs and sole props get crushed by insurance and benefits providers. It’s a barrier to entry.

Procurement: build a network of networks (GPOs or group buying) and wrap procurement in financing, sourcing, and inventory management.

Creators x SMB: use existing audience and expertise to drive customers and revenue downstream. The next Ray Kroc will be a youtuber.

You can read all about the specific bets we want to make/places to build startups, how we think about underwriting them, and what to avoid in much more detail our deck.

But as a Thesis Driven reader, what does any of this have to do with real estate and the built world? Why should you care?

In this next decade of accelerated SMB formation and real economy economies, we see a few distinct opportunities for leaders in the built world:

More fragmented real estate demand;

More opportunities for founders with real world operating experience;

More need for investors who can underwrite services (equity, debt, equipment finance, etc).

Founders with real world operating experience

As venture and startups move away from building software for software companies and into some combination of serving real economy companies with necessarily more hybrid business models beyond SaaS, the founder profile/skillset changes as well.

Whether it’s growing through field sales, building and operating units yourself, or just doing a lot of hand holding with customers/partners, SMB-oriented companies are always dirtier and more service oriented than their last-cycle counterparts.

That means more need/opportunity for founders and execs who have built and run businesses in the real world (“atoms vs bits”). To build the right products you need to know the problems intimately. To sell into the market you need to communicate with customers effectively. To identify obscure markets you need earned insights.

That looks very different when the product, market, and customers shift down toward more small businesses or even “companies of one.” We’ve already seen this take shape in the backgrounds of founders/compositions of founding teams.

The necessity for talented, technical teams will never go away but “cracked engineers” aren’t enough for these more complex categories. You need depth to navigate deep waters.

Investors who can underwrite it

As the business models get increasingly complex, so too do the capital structures and requirements. Whether it’s the startup equity, debt to open new units, or LOCs for equipment the investors with more flexible capital to “fuzz the categories” will have lots of opportunity. The idea of a “venture bank” or funds that cross over across multiple asset classes to service tech companies isn’t new but it may be becoming the dominant model for how big and small players approach the market.

Firms on the high end like General Catalyst (venture, growth, debt, buyout, asset management) and Thrive (which just created a permanent capital holdco for operating businesses) and on the low/boutique end like Mucker, Unwritten Capital, or Upper90 (credit, venture, real estate, growth) are going this way. Underwriting (private) tech is moving away from simple napkin math and toward something simultaneously more creative and sophisticated. Exciting times for those willing to do some financial bushwacking.

And finally, growth buyouts

There won’t be infinite scaled software companies (the end of SaaS) and the unsold/unexploited opportunities are that way for a reason; they have problems that don’t necessarily get solved by “better products.” These are distribution problems that need to be solved by a totally different GTM and capital structure than a traditional/pure play vSaaS.

So some industries will be transformed by software via new players competing on the basis of proprietary technology/IP. For many founders building vertical-specific software, combining with an incumbent to compete is the best way to capture value from their innovation/product.

Software, not B2B SaaS, will eat the world.

We funded Metropolis, which started as a vertical software company for parking lots, to go vertical and begin buying and transforming parking lot operators while owning the upside. Buy the customers instead of selling to them. Metropolis has gone on to buy the biggest public company in its category, SP+, for ≈$1.6B - taking it private to rebuild it around its proprietary software.

While this might seem contrary to the mission of SMB enablement, we think this will be the right way to modernize extant large incumbents. So rather than trying to buy small companies, we think startups and tech founders should take one of two extremes. The winners over the coming decades will be consolidators who install AI and own the upside (directly or indirectly) or decentralizers who enable independence.

Startups and venture capital is waking to the new reality of more compound companies operating in the real world and serving those who do. Private equity, real estate, operators, and large brands are getting there as well. The next wave of wealth creation through technology won't be building software or AI for software or AI companies; it'll be a hybrid approach that requires more breadth across categories than technical excellence alone. Power to the operators.

What are you gonna do about it?

—Yoni Rechtman

You can follow Yoni on Substack or Twitter. And you can read the full SMB deck here along with Slow’s Growth Buyout Thesis on software-led buyout platforms.