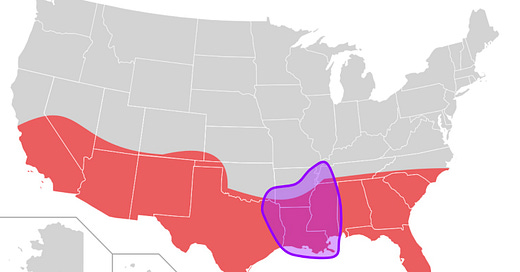

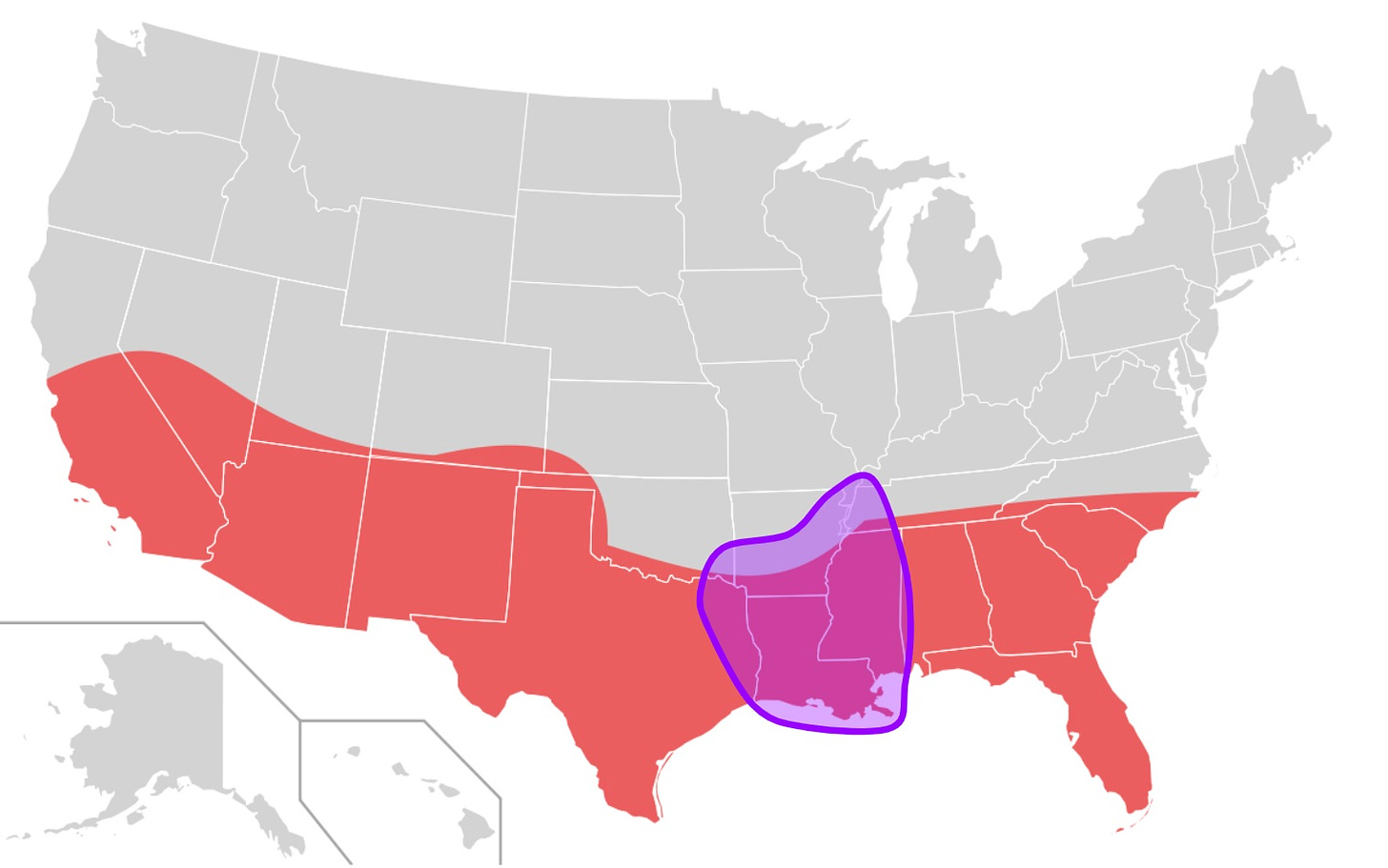

Real estate investors love to say they invest in the “smile states.” The “smile”—running from the US Southwest through Texas, Florida, and the Carolinas—includes many of the US’s most attractive real estate markets with strong job growth, warm weather, business-friendly policies, and tailwinds to asset price appreciation.

But there’s a 500-mile gap in the smile comprising most of Arkansas, Louisiana, and Mississippi. While much of the South experienced a renaissance beginning in the 1980s which ushered in rapid urban development and growth, the “gap” continues to lag across almost every measure of educational attainment, quality of life, investability, and human development. When real estate investors say they are hunting deals in “Sunbelt markets,” they’re typically not referring to Shreveport, Louisiana or Jackson, Mississippi—despite those cities getting plenty of sun.

This isn’t a mere academic interest: I grew up in the gap. I spent the first 13 years of my life in Calhoun County, Arkansas followed by a few years in each Texarkana, Texas and Shreveport, Louisiana. My cell phone still sports a 318 area code. My parents live there. To me, this is personal.

Today’s letter will explore “the Sunbelt gap” as a region from a real estate development perspective. We’ll touch on the headwinds the ArkLaMiss area has faced and how it is positioned (or not) for growth and real estate investment in the future.