The Rise of Shippable Microfactories

Can microfactories solve prefab's economic problem by inverting the factory model?

Nick Durham is a General Partner at Shadow Ventures, a venture capital firm focused on investing in frontier technologies for the built world.

Traditionally, prefabricated construction has meant large fixed factories churning out modules or panels that get shipped to building sites. The siren song is industrial-esque economies of scale in an industry that’s long evaded affordability and efficiency. But those centralized models, made infamous by companies like Katerra, General Modular Homes, and Skender, have faced challenges due to large up-front capex requirements and the hefty cost of shipping fabricated products to construction sites.

The emerging microfactory model flips that script. Instead of shipping bulky housing components from a distant plant, why not ship the factory itself to the project? In other words, take a compact, automated production unit (often the size of a shipping container) and set it up right next to the jobsite. The factory becomes a portable product, and the building components are made where they’ll be used—a true inversion of the old “fixed factory, shipped goods” paradigm.

By making factories shippable and goods more locally produced, microfactories aim to capture the benefits of off-site fabrication (automation, efficiency, indoor conditions) without the drawbacks of centralized production.

Today’s letter will explore the microfactory phenomenon, including:

What a shippable microfactory is

Frameworks for deciding when microfactories add value to construction projects;

Examples of shippable micro-factories in action;

Future directions and how shippable micro-factories could transform construction as we know it.

What is a Shippable Microfactory?

A shippable microfactory is a compact, self-contained production unit designed for deployment on or near the site of building construction. It combines automation, modular equipment, and digital coordination to enable localized, on-demand manufacturing. It can perform tasks like cutting, framing, and assembling parts using software-driven automation.

Each project’s digital design feeds directly into the microfactory’s machines, enabling components to be custom-fabricated on demand. The key distinction from a traditional prefab plant is scale and mobility: a conventional facility is large, stationary, and optimized for high throughput (but comes with high overhead), whereas a microfactory is small, movable, and deployed per project.

By trading size for agility, microfactories deliver many of the same benefits – precision, speed, controlled environment—in a temporary, on-site setting. Once a project is finished, the microfactory can be packed up and shipped out for the next job. Portability is the real breakthrough. In a sense, the factory itself becomes a productized tool that a builder can deploy as needed, rather than a permanent asset that must be kept busy at all times.

The Factory Efficiency Equation: Output per Labor and Capital Unit

How can we determine if any factory is economically viable? One useful lens is factory efficiency, which measures the value of output produced relative to the cost, adjusted for the level of utilization.

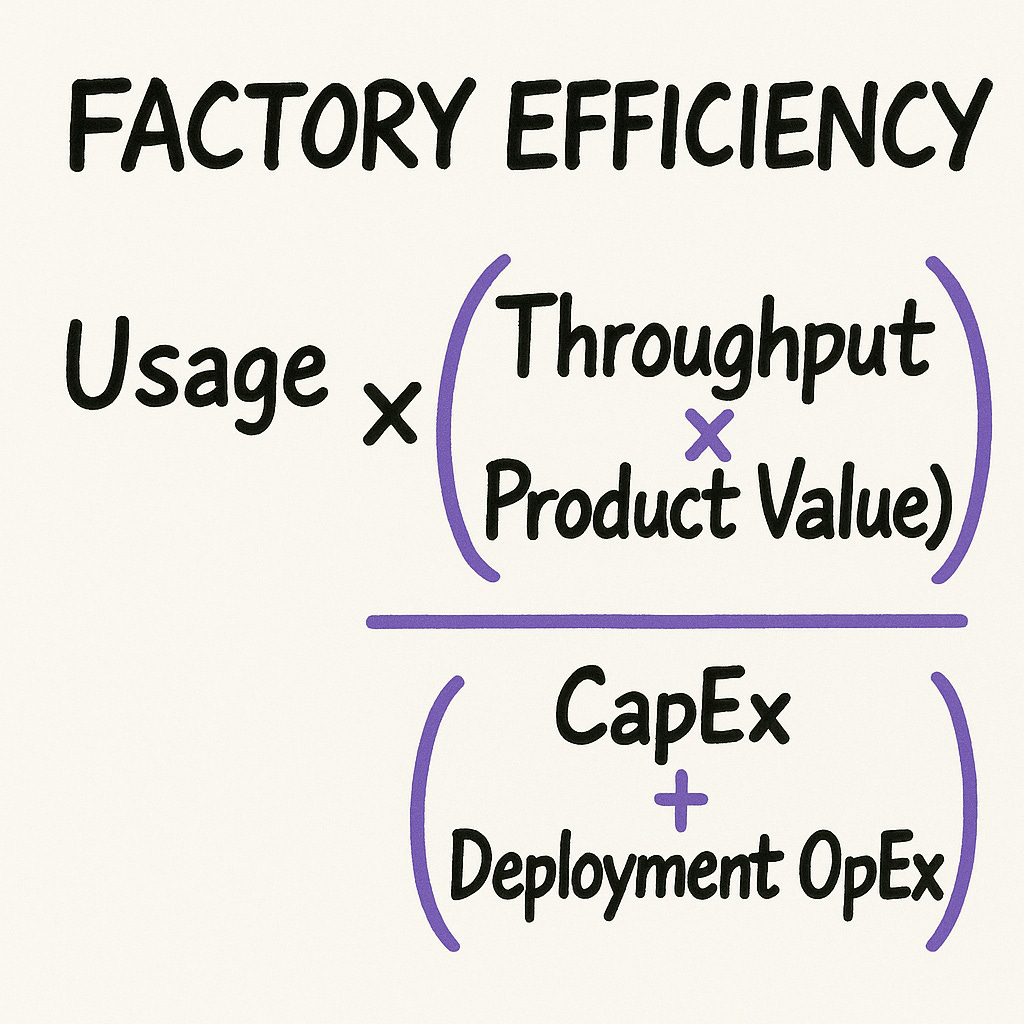

A simplified expression could be:

Factory Efficiency=Usage×(Throughput×Product Value)/(CapEx+Deployment OpEx)

In this formula, Usage is the fraction of time the factory is actively producing; Throughput is the production rate (e.g. units per month); Product Value is the value (or revenue) per unit produced; CapEx is the capital cost of the factory equipment; and Deployment OpEx is the operating cost to set up and run the factory for the project (labor, maintenance, site power, etc., excluding raw materials). A higher value means more output per dollar of cost, when normalized for utilization.

This equation highlights the trade-off between scale and utilization. A traditional large factory might have very high potential scale/throughput, but if it’s only running at 50% capacity due to bumpy demand, its effective efficiency plummets. The denominator (high CapEx and overhead) remains high, while the numerator (actual output * value) is under-realized, driving up the cost per unit. This has plagued many modular construction firms where demand is irregular, so factories often run below optimal capacity, undermining their economics. Some ended up chasing far-flung or low-margin projects just to keep their assembly lines busy, which is a symptom of poor efficiency from underutilized capital.

A shippable microfactory tackles this by primarily focusing on a high Usage factor. Because the microfactory can be packed up afterwards and reused, its capital cost gets amortized over multiple projects, effectively raising its overall Usage across the year. If one project alone doesn’t fully occupy the factory, it can simply roll over to another job to maintain high utilization. Its CapEx is often an order of magnitude lower than a mega-factory, so the breakeven throughput is more achievable on a small pipeline of work.

As a real example, British Offsite recently built a new high-volume prefab facility in the UK for £45 million, targeting ~4,000 homes per year capacity (about £11k of factory investment per annual unit). Even if a shippable microfactory costs around £0.5–1M, that’s on the order of just £3k–£6k of CapEx per home per year, significantly less capital per unit of output.

Multiple microfactory units can run in parallel to boost throughput when needed, but a builder can start with just one or two, dramatically lowering the entry barrier. The deployment OpEx for a microfactory (site setup, a small crew, utilities) is also relatively low and tied only to the project duration, not a permanent fixed overhead.

From a unit-cost perspective, microfactories aim to meet or beat conventional construction costs while adding efficiency. Consider a few benchmarks for context:

On-site stick framing: Building a house frame by hand costs roughly $7–$16 per square foot in the U.S., just for the carpentry labor.

Panelized construction: A pre-fabricated structural insulated panel (SIP) typically costs between $10 and $18 per square foot for the panel itself (materials only, not installed). That is more expensive than raw lumber per foot, because you’re paying for factory labor and fabrication.

Prefab wall panels vs. lumber: In general, prefabricated wall panels “cost more upfront per square foot than raw lumber.” However, the overall project cost can drop once you factor in the on-site labor savings, reduced waste, and faster schedules. In other words, you pay a bit of a premium for the prefabrication, but you often gain it back in time, efficiency and predictability.

When robotics advancements continue to bring speed of production higher and the overall cost premium lower, what do you expect to happen to the adoption of microfactories?

Spectrum of Shippable Microfactory Configurations and Use Cases

Shippable microfactories for housing span a spectrum of configurations, varying by level of on-site deployment, capital intensity, and scope of work. At one end are lightweight robotic setups that handle only structural framing, while at the other are large-scale mobile plants that output nearly complete homes. There are also hybrid approaches that bring alternative fabrication processes (like 3D printing or CNC cutting) directly to the jobsite. Below is a mapping of this range, with examples:

Lightweight Robotic Framing Factories

At the low-capital end, companies like AUAR deploy compact robotic factories focusing on structural shell fabrication. These microfactories are pop-up automated framing stations. For example, AUAR’s unit comes in a standard container and assembles timber wall, floor, and roof panels using an integrated robot arm.

The containerized system can be shipped to a development site or local yard and be operational within weeks. Because the scope is limited to the structural envelope, the machinery is simpler (a few robotic workcells vs. an entire production line) and the upfront investment is minimal. AUAR even offers it as a service model with no CapEx for the builder. AUAR’s system can erect a full single-family home shell in ~12 hours even with an unskilled crew. After the frame is up, conventional trades still handle mechanical/electrical fit-out and finishes, but the overall project timeline and labor requirements drop substantially.

This category of microfactory is ideal for a developer or homebuilder looking to scale framing efficiency and/or production in existing regions (or new markets where labor uncertainty is a constraint). They would deploy microfactories without investing in a permanent factory. AUAR even offers a leasing option so that if you don’t want to own a microfactory, you can simply lease them for a monthly fee based on usage as projects arise.

Full-Scale Microfactories for Turnkey Building

At the upper end of the spectrum are integrated microfactories that act as full general‑contracting plants under one roof. Cuby is the clearest example: its deployable facility includes dedicated stations for structural framing, bundled MEP assemblies, insulation, and interior prep, producing a complete kit‑of‑parts ready for rapid on‑site assembly. A single Cuby factory costs roughly $10-15 million to commission (light relative to a regional prefab megafactory but still a good upfront bite) and can turn out hundreds of homes per year. Cuby selects sites with deep, steady demand, typically within a 200-mile radius, which yields approximately 15,000 permits annually. At that scale, the plant needs to capture only two hundred units annually to run near full utilization, so it stays put for five to ten years before relocating. The reward for that commitment is factory‑level productivity without the logistics burden of long‑haul module shipping.

Reframe Systems follows the same turnkey logic at a smaller footprint. It's local “robotic microfactory” cranks out closed panels and volumetric modules with pre‑installed insulation, windows, and services, chasing net‑zero performance targets. CapEx is reported in the low single‑digit millions, and output is sized for a metro‑area pipeline rather than a single master‑planned community. Like Cuby, Reframe sells the promise of factory precision and schedule certainty but anchors the plant close enough to projects to keep trucks, labor, and capital cycling at high speed.

These heavy‑duty microfactories are best suited to builders with multi‑year volume commitments. They deliver factory efficiency and consistent quality while keeping designs configurable for local codes. The trade‑off is operational complexity and a higher capital stake up front, so the model only pencils when reliable throughput can justify the spend.

Alternative On-Site Methods (CNC Fabrication)

A hybrid approach is exemplified by Facit Homes (UK), which brings a microfactory to the site in the form of a containerized CNC machine. Facit’s system digitally fabricates custom timber components (think of large interlocking plywood pieces forming a structural chassis) right on-site, tailored to each unique design). The CNC router sits in a shipping container that is moved from project to project, cutting panels and structural elements that are immediately assembled a few meters away, essentially creating a one-home temporary factory. This method saved on transport logistics (only raw material sheets are delivered, finished components do not travel) and enabled fully bespoke architecture without the overhead of a permanent factory.

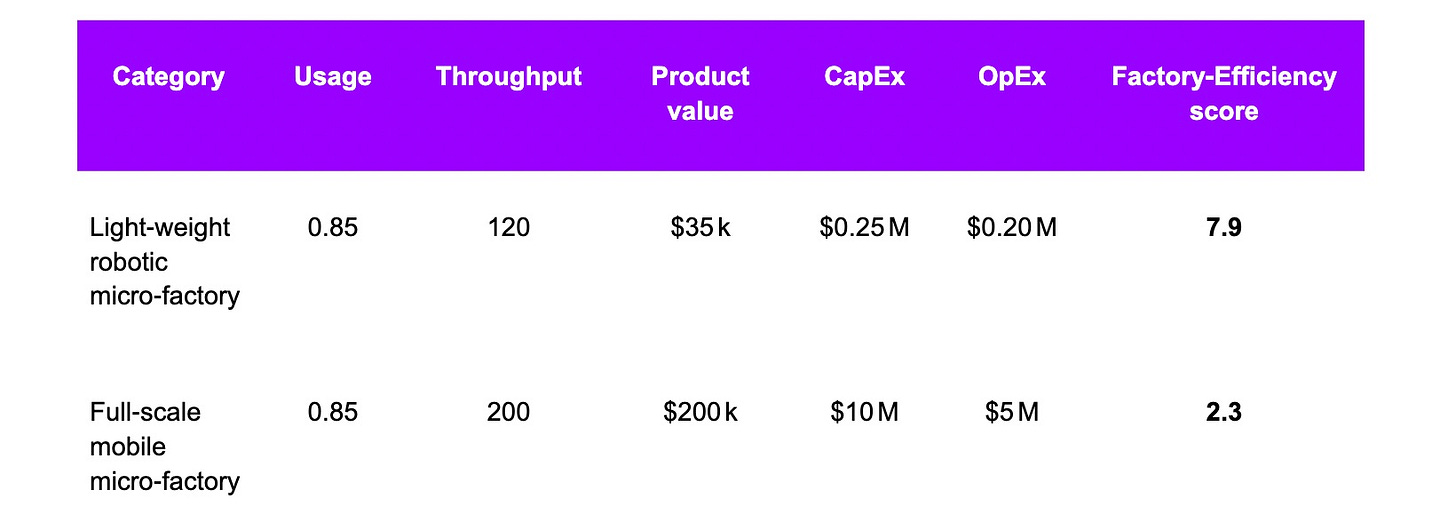

Applying the FE Equation

Checking our equation, the math confirms that keeping CapEx granular and movable, while running near full utilization, unlocks an order-of-magnitude advantage in factory economics for construction. Even assuming the same usage, low CapEx changes the game.

A Microfactory in Action: AUAR’s On-Site Robotic Factory

What does a shippable microfactory look like in practice? One of the first real-world deployments comes from UK-based AUAR (Disclaimer: Shadow Ventures is an investor and has permission to share this data).

In late 2024, AUAR completed a two-story office building in Belgium using a robotic microfactory on-site. This pilot project was fully manufactured with a single compact robotic work cell set up at the construction site, rather than in a huge factory. AUAR’s shippable microfactory (essentially an ABB robotic arm with specialized tooling, housed in a container) fabricated all the structural components of the building: timber wall panels, floor cassettes, roof elements, etc. According to the company, this was among the first buildings in the world produced entirely by a robotic system in a temporary, deployable factory.

Notably, the microfactory was able to prefabricate the building’s shell extremely fast: roughly under 8 hours of machine runtime to produce all the components for the structure. For context, stick-framing that structure by hand might take a crew several days or more. Even a traditional prefab factory might spend a day or two of production time per house worth of panels. Here, it was done in essentially one business day of automated work.

The microfactory rapidly provided the precise “core and shell” components. Human tradespeople took over to do the interior finishes, MEP (mechanical, electrical, plumbing) systems, insulation, and exterior cladding, much like a normal build. This hybrid approach (automate the heavy structural work, then assemble the rest) strikes a balance between factory precision and on-site customization. According to the local building partner, the robotic cell reduced the framing labor by roughly 80% and compressed that portion of the schedule from approximately one work week to one shift.

AUAR also intentionally varied the design (different window sizes, placements, etc.) to prove that one microfactory can handle non-repetitive builds without losing efficiency.

Technical Hurdles & Future Expectations

Shippable microfactories are still in their early days, but their role in construction is poised to grow. Here’s what I’d expect to see in the coming years:

Technical Hurdles

There are many technical hurdles to solve in order for microfactories to be a true breakthrough product. For instance, robotic systems must calibrate itself on a dusty yard, sense warped lumber, drive nails in tolerance, and flag errors so a single low‑skill operator can simply press go.

Power is another variable where most construction sites lack 480 V three‑phase, so there’s a need for an integrated step‑up transformer or battery skid that guarantees stable current without a utility upgrade. Material variability follows: the system has to auto‑tune cutting and fastening for spruce today, LVL tomorrow, or even light‑gauge steel, with no tooling changeover.

Finally, the design stack must run structural calcs, code checks, and tool‑paths in minutes so a house plan drawn at dawn flows into production the same day.

Microfactory Fleets

Instead of one factory per company, builders might operate multiple microfactory units as a coordinated fleet. For a large development, they could dispatch 5–10 microfactories to work in parallel, or spread units across a region for many smaller projects simultaneously.

Managing such a fleet will require advanced scheduling and logistics software (possibly AI-driven) to allocate factory units efficiently. We may also see specialized service firms maintaining fleets of microfactories and renting them out (akin to equipment rental). This would let construction companies scale their prefab capacity up or down on-demand by adding or removing microfactory units.

This essentially turns construction into a decentralized network of mini-factories that pop up where needed. Early signs of this model are emerging, some startups are indeed offering “factory-as-a-service” where developers lease mobile production units along with training and support.

Low CapEx/Subscription-Based Deployment

The business model is likely to shift toward a subscription or pay-per-use approach. As mentioned, AUAR and others are providing microfactories on a no-CapEx lease, which lowers adoption barriers. In the future, a contractor might subscribe to a microfactory like a cloud service—e.g. pay a monthly fee or per square foot of panel produced, which includes the equipment, software, and support. This aligns incentives: the provider keeps upgrading the tech (since they retain ownership and want long-term users), and builders get predictable costs and flexibility.

Even small construction firms could access cutting-edge automation on a project-by-project basis. Manufacturing capacity becomes a rentable utility. This shift from upfront investment to operational expenditure could fundamentally change how projects are financed and executed in construction.

Localized Supply Chains

If production becomes more distributed, building material supply chains will need to adapt. Instead of one big factory receiving massive shipments of lumber or steel, a network of microfactories will each need materials delivered to their temporary sites. This could give rise to more localized supply hubs. Standardization of inputs may improve so that any microfactory can plug into a local supply easily.

On the flip side, fewer large modules would be hauled cross-country, reducing long-distance freight. Overall logistics could become leaner and more local. Communities might prefer this model since it keeps more economic activity (and jobs) in the local area rather than in a distant factory. One can envision a large project where material vendors, microfactory units, and assembly crews all co-locate on a “mobile construction campus” for efficiency.

Regulatory and Code Adjustments

The rise of on-site fabrication cells will pose new questions for regulators and inspectors. Traditionally, offsite-fabricated components (like modular units or roof trusses) are subject to separate factory certification and then inspected upon arriving to site.

Suppose a microfactory is building components at the jobsite. In that case, it blurs the line. Is that considered offsite manufacturing (needing a third-party factory approval) or just on-site construction under the normal local inspection process? Building departments will need clear guidelines for temporary factories.

Shippable microfactories grew out of prefab’s hard lessons. Instead of funding a distant plant that ships components, we now ship the plant itself. A container-sized, digitally guided line can be dropped where the work is, run at near full utilization, and then moved when the pipeline shifts.

That keeps the numerator - throughput and value - high while holding CapEx and OpEx in check, so factory efficiency finally works in construction’s favor. The aim is not to replace every craft or regional factory but to add flexible manufacturing capacity that follows demand and lowers risk.

Builders and investors get faster schedules, predictable quality, and capital that sweats harder. In this model, the factory becomes an integral part of the product, signaling a more adaptive approach to building production.

—Nick Durham