Who is Investing in Real Estate Tech? 1H 2025 Edition

Our updated list of firms actively investing in real estate technology companies. Is the turnaround here?

Every six months, Thesis Driven publishes the results of our biannual real estate tech investor survey in which we poll representatives of more than 50 venture firms known to invest in the real estate tech category. (You can find last year’s results here).

The first half of this letter will be dedicated to the results of our poll, and the second (post-paywall) half will provide our detailed list of individual firms.

Upcoming Class: Thesis Driven’s Paul Stanton is teaching the Basics of Real Estate Underwriting tomorrow (Feb 19th) at noon ET! It’s a bite-sized hour-long program offering an introduction to underwriting real estate deals. Check it out here.

Investment Activity

The glimmers of bullishness from the last two polls accelerated with more than 80% of investors expecting an increase in real estate tech investment activity over the next 12 months. In other words, we’re seeing a clear consensus that we’ve found the bottom—of investment activity, at least.

As in past surveys, we include a number of generalist investment firms with a track record of doing real estate tech deals in addition to proptech-specific firms. Notably, the generalists tend to be a bit more bearish on real estate tech than the specialist firms.

Stage

Investment stage has been one of the more interesting trend lines over our past few polls. Notably, we’ve seen a pullback in interest from the earliest stages as interest in Series B and growth rounds has grown, a substantial shift from 2022-23. Over the past year, the number of responding firms claiming to do “Pre-seed” rounds has dropped from 69% to 52%, while the number claiming to do growth rounds has grown from 12% to 19%.

It’s worth noting that while we (mostly) poll the same firms every time, we don’t have 100% response rate, so the respondent cohort slightly changes. But I think that’s interesting in its own right; firms with exciting new investments to share generally respond whereas firms who have been sitting on their hands for the past two quarters conveniently miss our emails. And the decline in pre-seed interest, for instance, is large enough to supersede any cohort effects.

Sectors

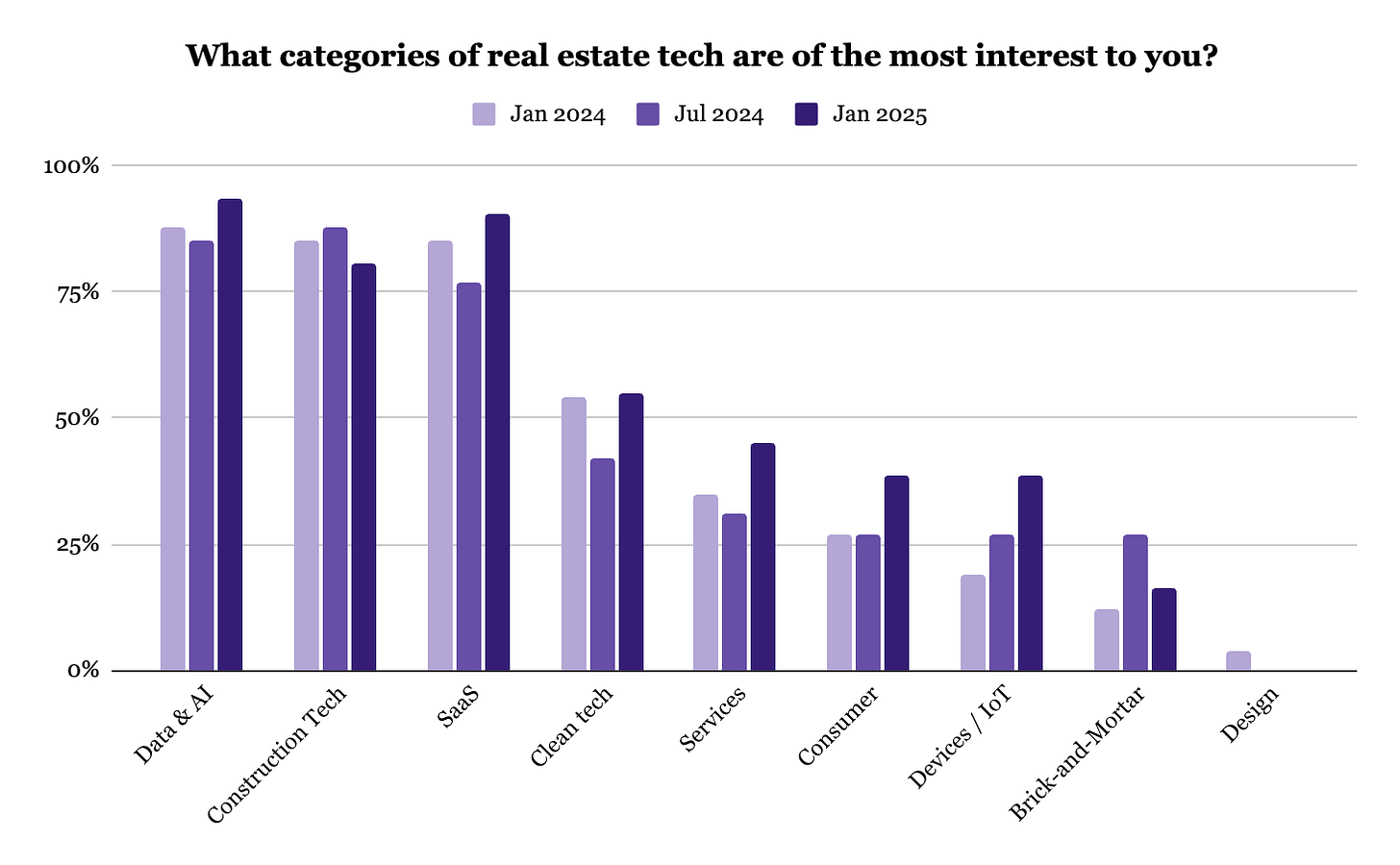

The hot sectors of real estate tech have been remarkably consistent over the past few polls. Data & AI, construction tech, and SaaS dominate, with clean tech, services, and consumer products generating niche interest.

Notably, this poll indicated a broader interest across sectors than in prior polls, with the average investor expressing interest in more sectors. I read this as just a general symptom of increased bullishness—whereas investors a year ago were narrowly focused on a few hot categories, they’re more willing to engage broadly across the proptech spectrum today.

The most notable winner is probably devices/IoT, interest in which rose from 19% a year ago—likely depressed by several high-profile failures—to 39% today.

Now, onto our list of active real estate tech investors. For most firms, we were able to gather:

Whether or not they “lead” rounds and are still making investments;

Stages at which they invest;

Sectors of real estate tech of most interest;

Whether they invest in “PropCo” structures as well;

An example recent investment.

Read on for the full list. If any investors not on this list would like to be included, please reach out to me at brad@thesisdriven.com for a link to the poll.