Today’s Thesis Driven is the latest installment of our deep dives into specific innovative companies. You can check out our first two deep dives into Ownify and Neutral.

Few trends are changing the multifamily industry more—and faster—than centralized operations. Over the past five years, a growing number of apartment operators have been bringing entire operational functions from the on-site management office to centralized back offices, unlocking efficiencies and standardizing practices.

But the story of centralization isn’t just about operations. Centralization goes hand-in-hand with technology, both demanding new systems as well as unlocking the adoption of next generation tools—specifically, AI.

Today’s letter will explore centralization tech through a deep dive into EliseAI, a company taking a broad approach to building the tools required for centralization. With $75 million in fresh capital, Elise is one of proptech’s newest unicorns.

Specifically, today’s letter will tackle tackle:

The story of multifamily centralization, including opportunities and challenges;

EliseAI and the role of AI in unlocking centralization;

Examples of specific tech at work;

AI’s capabilities over the next 2-3 years.

The Centralization Wave

For all the buzz about multifamily centralization, it’s a fairly simple concept: many tasks that have traditionally been performed on-site are actually better off being handled in a central back office, whether in the US or overseas.

While centralization has become a hot topic over the past several years, it’s not a new idea. Two decades ago, a small onsite team handled everything for an apartment building, from leasing and bookkeeping to tenant support. But the introduction of standardized property management tools—along with the demand for higher-quality accounting by institutional investors—led to the centralization of accounting beginning in the mid-to-late 1990s. The benefits of this move quickly became clear, as standardized financial practices became easier to enforce, and each back-office accountant could serve more units.

In other words, finance paved the way for the wave of centralization we’re seeing today.

Over the past five years, the centralization conversation has moved well beyond accounting. Multifamily operators are moving things like lease administration, tour booking, first-line resident support, and even maintenance dispatch to central back offices. While cost savings is a part of the rationale, operators are embracing centralization to better standardize processes, implement quality control, and alleviate staffing issues.

Centralization and Tech

But perhaps the biggest long-term benefit of centralization for owners is its role in enabling new technologies. Operational centralization simultaneously unlocks and demands new technology for a few big reasons:

Training and enforcing best practices are two of the toughest challenges of rolling out new technology on-site. Lack of on-site buy-in and training have doomed many proptech rollouts, and many owners and tech companies aren’t willing to commit the time and resources to visiting each property individually to train on-site staff. By bringing specific functions together in one place, centralization dramatically simplifies the embrace of new tech.

When the team operating a building is no longer sitting on-site together, communication and coordination become critically important. And the more that can be automated, the less that will fall through the cracks. Technology can play a critical role in both facilitating communication between remote and on-site teams as well as automating workflows and interactions previously left to (fallible) humans.

Finally—and perhaps most importantly—centralization unlocks savings from incremental efficiency gains. Prior to centralization, no one piece of technology was going to save enough staff time to justify reducing on-site headcount from (say) two to one leasing agents or one to zero associate property managers. But with a centralized workforce, headcount is tied to scaling factors—say, one leasing administrator for every 500 units—that can be incrementally changed based on efficiency gains.

While a number of startups are building AI-powered technology for real estate operators, no company is taking as broad of an approach—or is as well-capitalized—as EliseAI.

Founded as MeetElise in 2017, EliseAI “was initially started to solve the communication problem in multifamily buildings,” explained EliseAI co-founder and CEO Minna Song. Notably, Song and her co-founder Tony Stoyanov didn’t come from traditional real estate backgrounds. Both are technical, with Song and Stoyanov coming out of MIT and Cambridge computer science programs, respectively.

But rather than start a company off the bat, Song chose to spend time in the real estate industry to get familiarity with the problems, taking a role at a New York-based brokerage firm to be closer to the day-to-day issues facing the real estate industry. “Engineers tend to build things that don’t really solve anyone’s problem, and we wanted to avoid doing that,” said Song.

Song found that communication—specifically, communication between prospective tenants and management firms—was an unsolved problem. “At many management firms, prospective tenants couldn’t reach anyone, nobody would call back, nobody was following up,” explained Song. “It was particularly bad at times like Sundays or after hours when many prospects wanted to tour. It was still the early days of AI, but we realized we could automate this.”

So Song and her co-founder moved down to Arlington, Virginia to sit with AvalonBay, EliseAI’s early design partner and customer. “We wanted to be a fly on the wall and just listen.”

Elise was one of a number of companies focused on automating leasing prospect communication, a big trend of the pre-pandemic years. While many startups built “chatbots” which provided simple structured answers via webchat, Elise instead based its product on AI and multi-channel communications, betting on two trends that would ultimately separate the company from its peers.

From a technical perspective, these communication tools can work in two ways: they can be programmed from the top down, operating through logic trees designed by a human. A programmed chatbot will see the words “dog” and “fees” in a conversation with a prospective tenant and assume the prospect is asking a question about pet rent.

AI, on the other hand, uses natural language processing—models that have been trained over many, many conversations—to converse with the prospect. While the more predictable programmed chatbots offered advantages in the early years, AI quickly caught up, and EliseAI’s bet on artificial intelligence paid off and separated the company from the pack. “AI is best at handling open-ended conversations just like a person would,” added Song.

The benefits of off-hours coordination with prospective tenants in a voice that actually resembles a human—not a programmed chatbot—can be significant. Multifamily owner-operator Kittle Property Group, for instance, reduced lead-to-lease timeline by 65% and conversion rate by 8% by adopting EliseAI’s products, which enabled them to converse with prospects outside of the normal 9-5. (Back when I was in property management, I was always surprised how many tenants applied to apartments between the hours of 11pm at 5am, but as an operator you have to meet tenants when–and where–they are!)

Song notes that booking more tours isn’t always the goal, and a “good” AI agent will be able to tailor its behavior to the customer’s specific goals. “Some owners want to optimize for foot traffic,” said Song. “Others—maybe they don’t have a full-time leasing agent on site—want to qualify leads more first. The best AI will adjust to meet that goal.”

Elise and its clients have been rewarded for their early bet on AI by accumulating a who’s-who of more than 500 multifamily logos including EQR, Willow Bridge, RPM, Bozzuto, Cardinal, and more.

From its beachhead in leasing, Elise has since grown to offer a litany of products targeting an array of multifamily pain points from resident support to maintenance to lease audits to self-guided tours to delinquency and even offers prospects and clients mystery shopping of their communities. “We think in terms of bottlenecks,” explained Song when asked how she decides what products to launch. “We launched a self-touring product because we saw that the touring capacity of a leasing agent was the bottleneck. A lot of prospects want to tour from 5 to 7pm or on Sundays, and you can get higher throughput if you offer those options.”

A similar thought process brought the company to tackle property maintenance. “A lot of our customers are suffering from labor shortages,” said Song. “We have AI doing the triage of maintenance tickets. Once we decide a ticket needs to go in front of a human, we make sure we’re getting it to the right person and they’re completing it in the right order.”

“There are manual processes across every part of property management. The processes that have a human in them are the toughest—it requires sophisticated decision making to organize a team of maintenance staff. These are hard technical problems.”

To complement its software products, Elise has also rolled out consulting services to help multifamily operators tackle the stickier parts of centralization and automation, including figuring out what roles can be moved off-site or better handled with technology.

But perhaps my favorite Elise product tackles a specific—and very niche—bugaboo of mine familiar to anyone who has taken Thesis Driven’s Selling into Real Estate Owners course. Just last month, Elise released a marketing multi-touch attribution report taking on a sneaky hard marketing problem: figuring out which leads came from where in a world in which your best leads have seen your message multiple times across different platforms. God’s work, truly.

Elise in Context

It has become common among VCs and industry analysts to discount application-layer proptech software companies built on top of PMS platforms as “point solutions” that perhaps solve a single owner pain point but have little in the way of defensibility.

But EliseAI’s trajectory prompts an interesting question: how many points need to be solved before a point solution is no longer merely a point solution?

In a sense, it’s best to think of EliseAI not as a company with an AI product, but as a product company using AI to solve a litany of problems faced by the multifamily industry. EliseAI is using automation and applying AI to multifamily’s toughest problems, and its broad integrations and proven results suggest it will dodge the pitfalls that plagued earlier proptech platforms.

Consider its relationship with the PMS platforms, for instance. Like other proptech companies, Elise requires data from PMS platforms to function. “We coexist,” said Song. “We sync information such as units, availability, and details of each community. But the PMS is the source of truth for our customers.” Song notes that Elise integrates with “all the major PMS platforms” as well as a number of minor ones. “I think the industry wants open platforms and that’s generally been our experience,” said Song. “The customers want that, and the PMSes have to make their customers happy. It’s always been our experience that if a customer asks for something, they’re not denying their customer’s ability to use another service.”

The Long Haul of Centralization

From speaking with Song and others at EliseAI, it’s clear that they don’t simply view their product suite as a bolt-on tool for multifamily owners tackling centralization. Rather, they see Elise as the platform upon which centralization can happen, like Excel enables financial modeling or Hubspot enables marketing automation. “Over a million multifamily units have centralized with us,” said Song.

Note the phrasing “centralized with us” as opposed to, say, “used our software to centralize”—an approach indicative of how Song thinks about EliseAI’s tight relationship with multifamily operators. And while centralization is a hot topic at multifamily conferences and earnings calls, we’re still in the early days in terms of actual implementation—an adoption curve EliseAI is hoping to ride over the coming years.

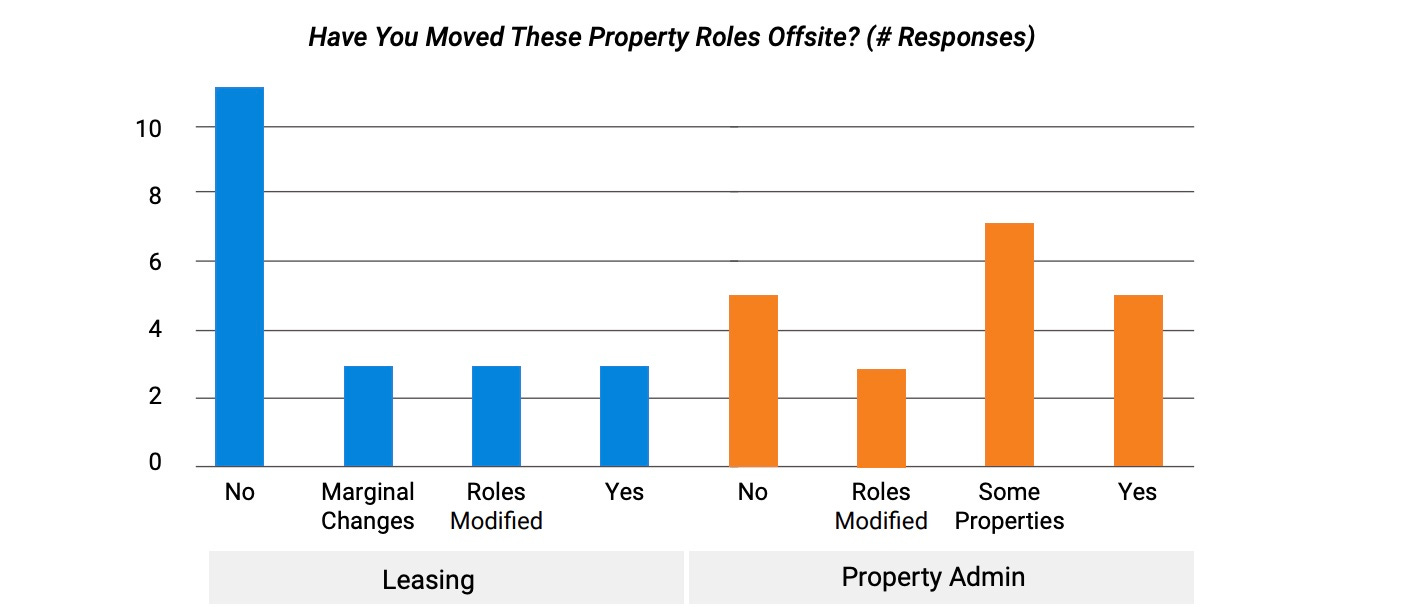

According to this year’s 20 for 20 survey, multifamily owners are still in the early days of adopting centralization–even if they’ve mostly decided it’s the right solution, especially for administrative functions. Fully 75% of operators polled either plan to fully move to a centralized model or (for third-party contracts) will centralize subject to owner approval.

But only 25% of those surveyed have fully centralized those functions, with another 35% having adopted centralization at specific properties.

If these results are any indication, centralization has a long way to go, and companies betting on a centralized future are likely to see growing demand—although it may take a while.

Third party managers—which represent more than half the multifamily market–present another barrier for centralization which EliseAI aims to crack. “If two properties with different owners share an employee, it’s hard to figure out how to split up that person’s time—and you don’t want to have disputes on how that time is being billed,” explained Song. “But it’s ultimately a technology problem. If you have an app and are tracking the work orders completed, you can actually divvy up those costs.”

For the meantime, Song and EliseAI are adapting to what the market gives them. “Some firms centralize one role at a time, some do all of it. Others centralize half a role and stop there,” said Song. “We’ve seen every flavor of [centralization] across our clients. You need tools that have the flexibility to go from fully on-site to fully centralized.”

—

While Elise’s push into multifamily hasn’t slowed, in 2023 the company launched a totally new vertical: healthcare. “We’ve built a pretty flexible platform, and we realized it could serve other industries too,” explained Song. “It’s a startup within a startup. The customer base is completely different, but they’re building upon the same platform.”

Today, EliseAI for healthcare serves a variety of B2C healthcare sectors including womens’ health, dermatology, orthopedics, and ophthalmology. Notably, Song adds that healthcare’s unique customer behavior—with far higher voice call volume—have provided hundreds of thousands of additional conversations upon which to train EliseAI’s voice product, sharpening the product for multifamily users as well.

While Thesis Driven’s thought experiment on the zero employee property manager caused a stir, it’s unlikely that multifamily operators will choose to burn the boats and fire their entire on-site teams any time soon. But it’d also be a mistake to ignore the impact that AI will inevitably have on what it means to run a modern multifamily building.

Rather than making one big, splashy change, automation and AI are making incremental impacts across a litany of different workflows and functions—impacts that, in the aggregate, will have a significant impact on how buildings run. When paired with centralization, the change could be tremendous.

EliseAI’s approach of building a lot of tools that each add incremental value and savings to a wide variety of operational functions mirrors how AI is changing operations in the real world. While to outsiders the effects may seem marginal today—a workflow automated there, an increased conversion rate there—we’ll likely look back in three years and find that everything has changed.

—Brad Hargreaves

Excellent article.